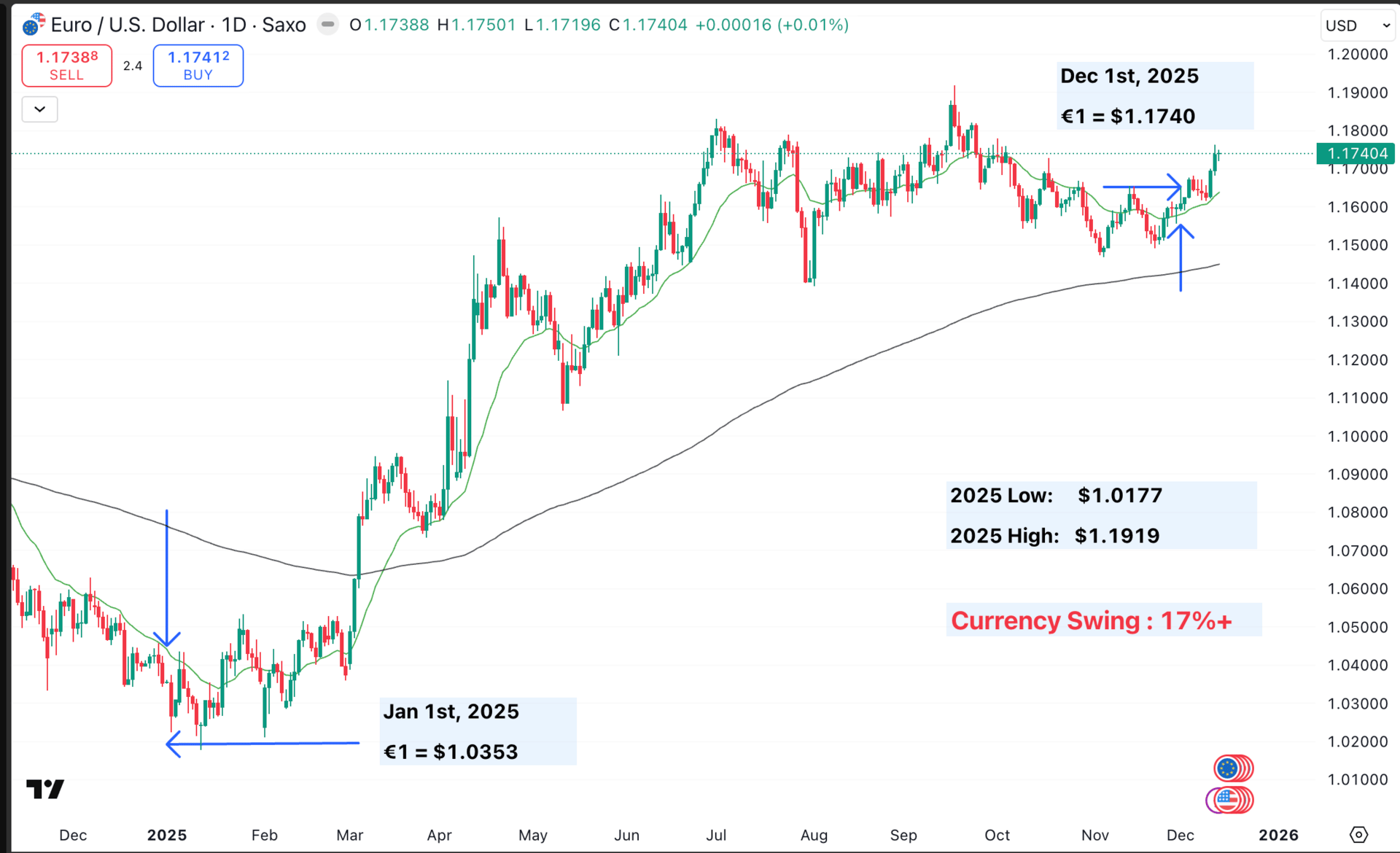

EUR/USD Daily Chart - 2025

If you're tracking the EUR/USD exchange rate, this week's chart is a must-watch.

As we wrap up 2025, the euro has surged nearly 17% against the U.S. dollar since January, climbing from a low of €1 = $1.0353 to a current rate hovering around €1 = $1.1738. That's pushing it perilously close to the year's peak of $1.1919, offering a stark visual of currency volatility and opportunity.

For overseas athletes, overseas property buyers, and cross-border businesses, this swing isn't just numbers on a screen—it's real money in (or out of) your pocket.

In this Chart of the Week, we'll break down the EUR/USD's dramatic 2025 journey, spotlight the key fundamentals driving it, and explore why this matters for everyday players in the global economy. Whether you're a European soccer star eyeing U.S. endorsements or a family scouting overseas property in Florida, understanding this rate can unlock smarter financial moves.

The Chart Breakdown: From Rock Bottom to Record Heights:

On January 1, 2025, the EUR/USD dipped to $1.0353 amid post-holiday jitters and a robust U.S. economy. Fast-forward to today, and the pair has clawed back ground with a steady uptrend, marked by green candlesticks dominating the chart.

Key milestones include a mid-year rebound from $1.1077 in March and a late surge past $1.1740 this week.The 17%+ currency swing is eye-popping—visualised by the chart's rising trendline pointing to December's highs. Volatility spiked earlier in the year with hesitation around $1.14, but bullish momentum took over by mid-summer.

The dollar's weakness has supercharged the euro, making European exports cheaper and U.S. assets more attractive for euro holders.This isn't abstract forex trading—it's a barometer for global trade.

As the rate nears $1.19, it underscores a year of U.S. policy pivots versus Europe's steady hand. For investors, timing matters: Entering positions early in the year would have delivered substantial gains by now.

Fundamentals Fuelling the Fire: Fed Cuts, Upcoming Liquidity Boost, and ECB Decisions

Behind the candlesticks lie central bank decisions that ripple worldwide. Last week, the Federal Reserve delivered another rate cut, trimming rates by 25 basis points. This dovish move signals a Fed prioritising growth, weakening the dollar by making U.S. yields less appealing to investors and directly boosting the EUR/USD pair.

Adding to the momentum, the Fed is set to launch significant Treasury purchases starting this month to stabilise liquidity. While not full-blown quantitative easing, this injection of cash is expected to keep downward pressure on the dollar into 2026, potentially pushing EUR/USD toward $1.20 if inflation remains contained. For Europeans, this means your euros stretch further when spending or investing stateside.

In contrast, the European Central Bank meets this Thursday, December 18, and is widely expected to hold rates steady—the fourth consecutive meeting without a cut. This cautious stance reflects Europe's cooling inflation and stable growth outlook, bolstering the euro through signals of fiscal discipline.

The key divergence—U.S. easing versus ECB stability—is the primary driver behind this year's chart. Widening interest rate gaps continue to favour the euro over the dollar.

Real-World Ripples: How EUR/USD Hits Home for Athletes, Investors, and Businesses

Let's make it personal. For overseas athletes, currency movements can significantly impact earnings. Consider a top European tennis or soccer player earning millions in USD from American endorsements or tournaments.

A stronger euro means those dollars convert to fewer euros upon repatriation. However, athletes who hedged earlier in the year at lower rates are now sitting on substantial gains.

On the investment side, Europeans buying U.S. stocks, bonds, or overseas property are in a sweet spot. A $500,000 property in Miami or New York costs far fewer euros today than it did in January—savings of over 13% on the exchange alone.

With U.S. real estate markets still competitive, this stronger euro makes overseas property more accessible for European buyers looking at vacation homes or investment opportunities.

Businesses feel the effects too. European exporters to the U.S. benefit from competitive pricing, while importers face higher costs. In sectors like sports tourism—think European teams touring the U.S. or fans traveling for events—the stronger euro reduces travel and ticket expenses for Europeans, boosting cross-Atlantic activity.

Outlook: Eyes on $1.20 and Beyond

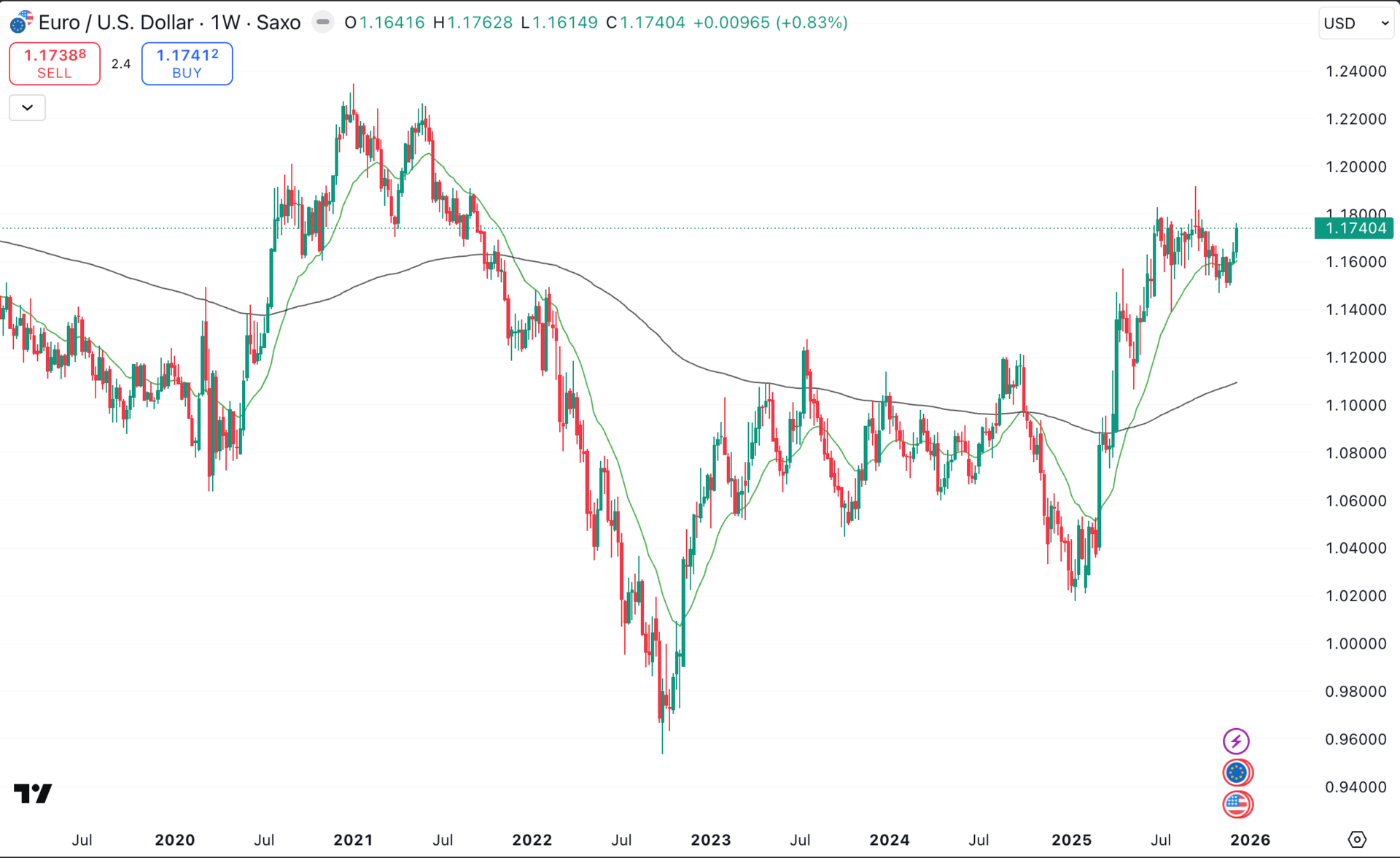

As EUR/USD flirts with yearly highs, 2025's chart tells a tale of U.S. accommodation meeting European resolve. Fed cuts and liquidity measures weaken the dollar; the ECB's steady hand fortifies the euro.

For overseas athletes, overseas property seekers, and transatlantic traders, the message is clear: Monitor rates closely, consider hedging, and capitalise on the opportunities.

What's next… Are we heading for the 2020 highs of $1.2350 ?

If this week's ECB meeting reinforces stability, we could test $1.19 soon—and possibly breach $1.20 in the new year. Track this EUR/USD exchange rate closely—your financial decisions may depend on it.

What's your take on this surge? Drop a comment below!

Technical levels give your triggers.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X