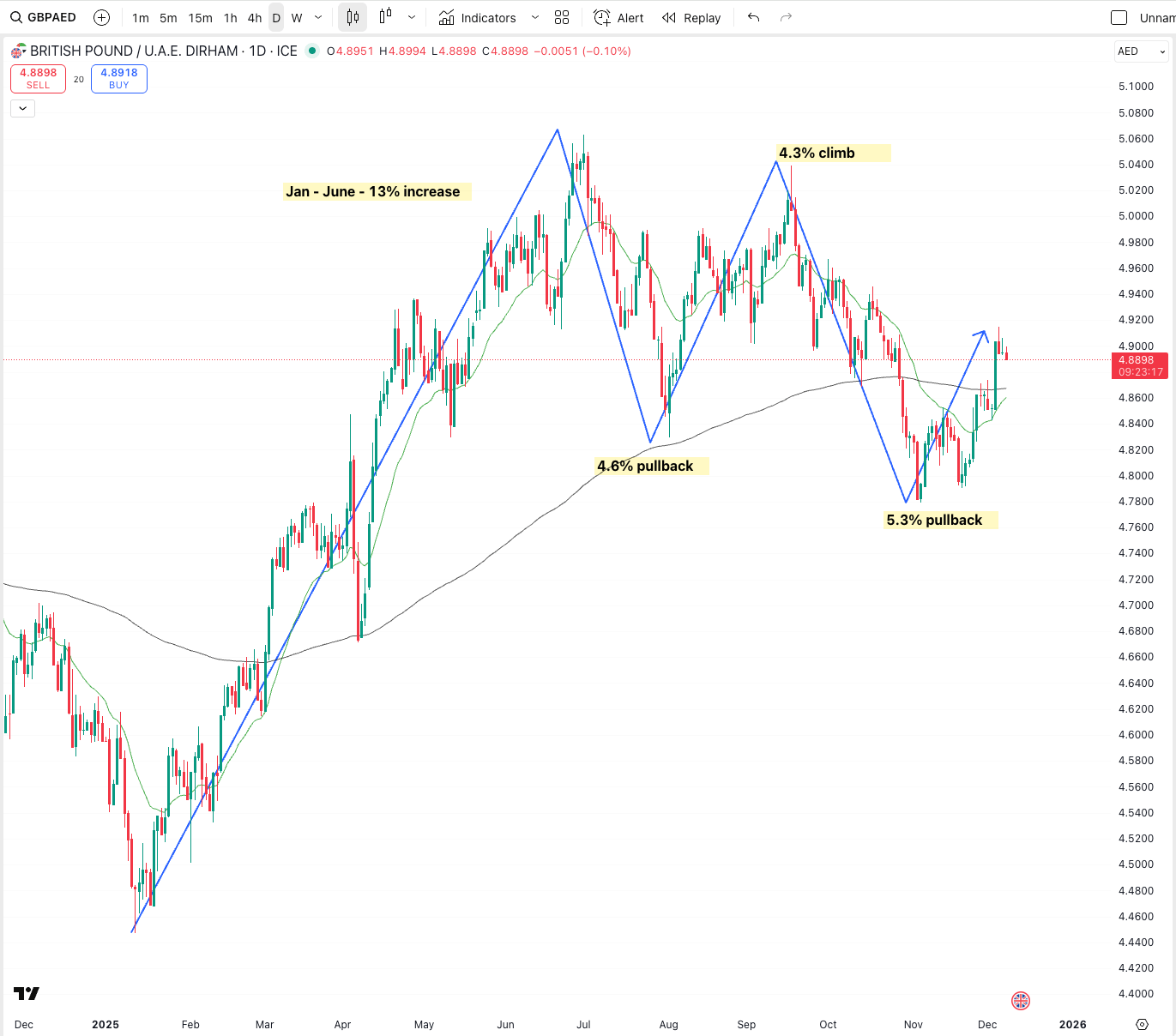

GBP/AED Daily Chart

Following up on our surge in property inquiries, this updated look at the GBP/AED daily chart highlights the specific volatility cycles we’ve navigated this year. While the Pound is up 7.9% since January 1st, the path has been defined by clear aggressive climbs and healthy pullbacks.

Key Market Movements Year-to-Date

The price action has formed a distinct "W-shaped" recovery pattern after the summer highs, as shown by the trend lines:

The H1 Rally: From January to June, the Pound saw a massive 13% increase, moving from the 4.48 level toward 5.06. This established the primary bullish trend for the year.

Strategic Pullbacks: * 4.6% Pullback (Aug/Sept): A corrective phase that saw buyers step in near the long-term moving average.

5.3% Pullback (Oct/Nov): The most recent major dip, which tested support around 4.78.

The Recovery Phase: We recently completed a 4.3% climb followed by a sharp bounce off the November lows. The current price of 4.8898 sits squarely in an upward recovery leg (indicated by the blue arrow).

Range-Based Analysis for Property Buyers

Phase | Percentage Change | Market Significance |

Jan - June | +13% | Rapidly increasing buying power for UK investors. |

Q3 Highs to Q4 Lows | -5.3% | A significant "sale" on the UAE Dirham for those holding Sterling. |

Nov to Dec (Current) | Recovery Underway | Regaining momentum above the 200-day moving average (grey line). |

Technical Outlook: Testing the Ceiling

The blue arrow on the chart signals the current trajectory: we are pushing back toward the 4.90 - 4.95 zone.

Support Foundation: The 4.80 level has solidified as the "floor" for the second half of the year. For buyers, any move back toward this level represents a high-value entry point.

Momentum Check: The Pound is currently fighting to stay above the 200-day moving average (the black line). Consolidating above this line is essential to turn the short-term recovery into a long-term bull run back toward 5.00+.

Actionable Insight for UK Investors

If you are moving funds for a property deposit:

The "7.9% Advantage": Despite the pullbacks, your budget is nearly 8% stronger than it was in January.

Managing Volatility: The recent 5.3% pullback demonstrates how quickly market gains can be erased. With the recovery leg currently active, now is a strategic time to set limit orders at higher levels or utilize market orders if your payment deadline is approaching, to avoid being caught in the next cyclic correction.

Using a benchmark budget of £250,000, the table below illustrates the "exchange rate bonus" gained between the start of the year and the current market position.

The £250,000 Comparison: January vs. Today

Date | GBP/AED Rate | Budget Value in AED |

January 1st, 2025 | 4.532* | 1,133,000 AED |

Current (December) | 4.890 | 1,222,500 AED |

Net Gain | +0.358 | +89,500 AED |

*Derived from the 7.9% year-to-date increase noted in the chart.

What does this "Exchange Rate Bonus" buy you?

In the current UAE property market, that extra 89,500 AED can be the difference between a successful entry and an overstretched budget. For a buyer with a £250k investment, this gain effectively covers:

Closing Costs & Fees: This amount is enough to cover the 4% Dubai Land Department (DLD) fee on a property valued up to 2.2 million AED. Essentially, the exchange rate movement has "gifted" you the taxes and registration costs.

Property Upgrade: Investors can now look at higher floors, better views, or an extra bedroom that would have been financially out of reach in January.

Furniture & Fit-out: 89,000 AED is a substantial budget for a full luxury furniture package for a studio or 1-bedroom apartment, meaning the property can be "tenant-ready" immediately without further out-of-pocket Sterling expenses.

Strategic Summary

While the market saw a peak in July (13% up from January), the current level remains highly favourable compared to the start of the year. The current recovery leg (blue arrow) suggests that GBP momentum is strengthening, offering a strategic window to lock in these gains before any potential year-end volatility.

Technical levels give your triggers.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X