AUD/USD Sits at a Key Level After a 2% Lift

The Australian Dollar has had a strong run over the past week and a half. We are up roughly 2 percent from the mid November lows, helped by a softer US Dollar and a hotter than expected Australian CPI reading. Today’s chart is a look at where the AUD/USD sits right now, why it has struggled to break higher, and what this week’s data could do next.

This pair is now back at one of the most important levels on the whole chart.

⸻

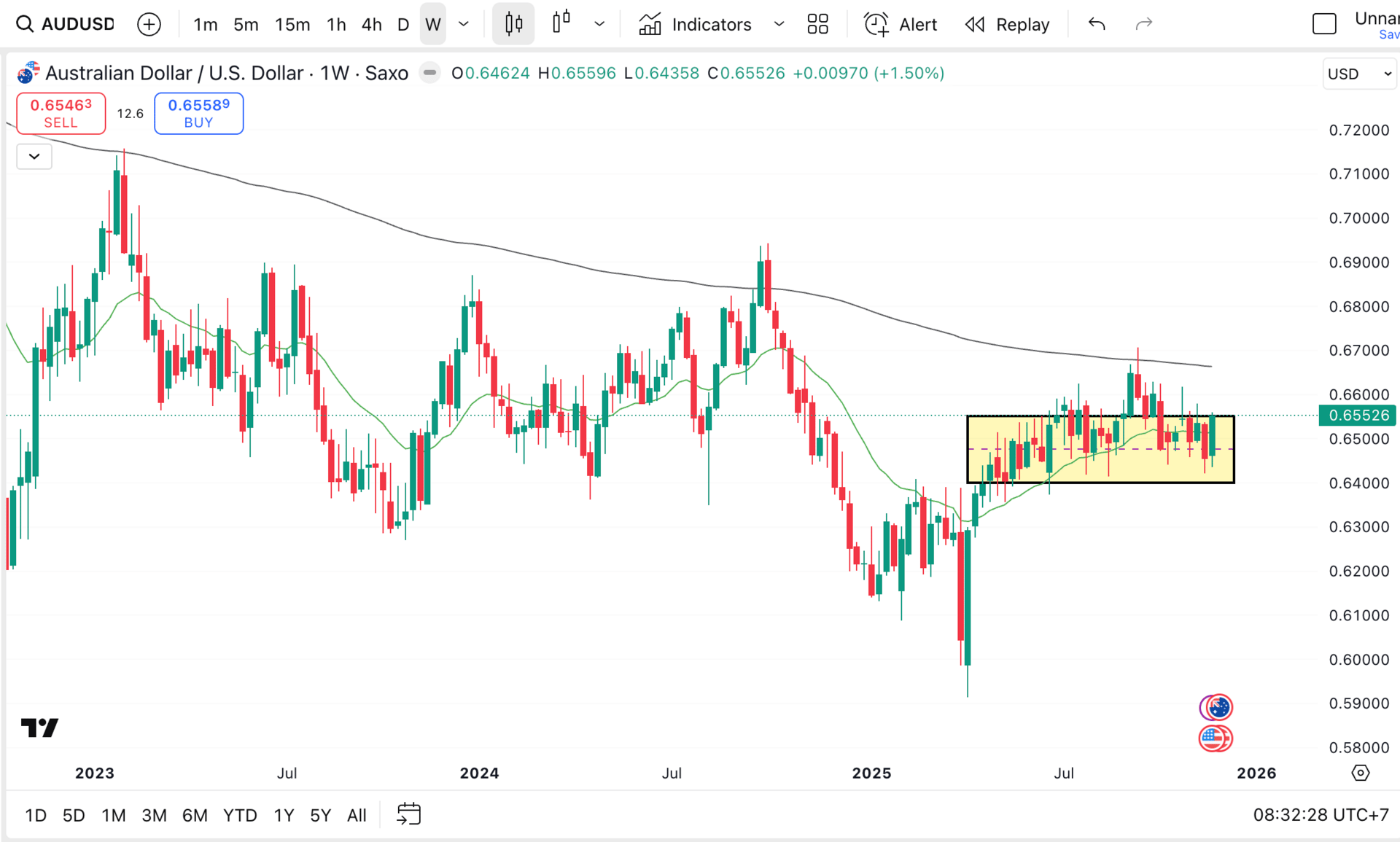

The Big Picture

Looking at the weekly chart, the Aussie has been climbing slowly since the sharp recovery back in April. From there it has spent months inside a very tight range of around 3 percent.

That is a long time to go sideways. In FX, when a pair sits still this long, it usually means the market is waiting for a major catalyst.

AUD/USD - Weekly Chart

👉 This week might be that catalyst.

The AUD has now pushed above its 200 day moving average, which is a positive sign, but it has not been able to break away convincingly. Every time we get near 0.6550, the market stalls. Buyers cannot push through and sellers do not have enough momentum to push it lower either.

That is what makes this level important.

⸻

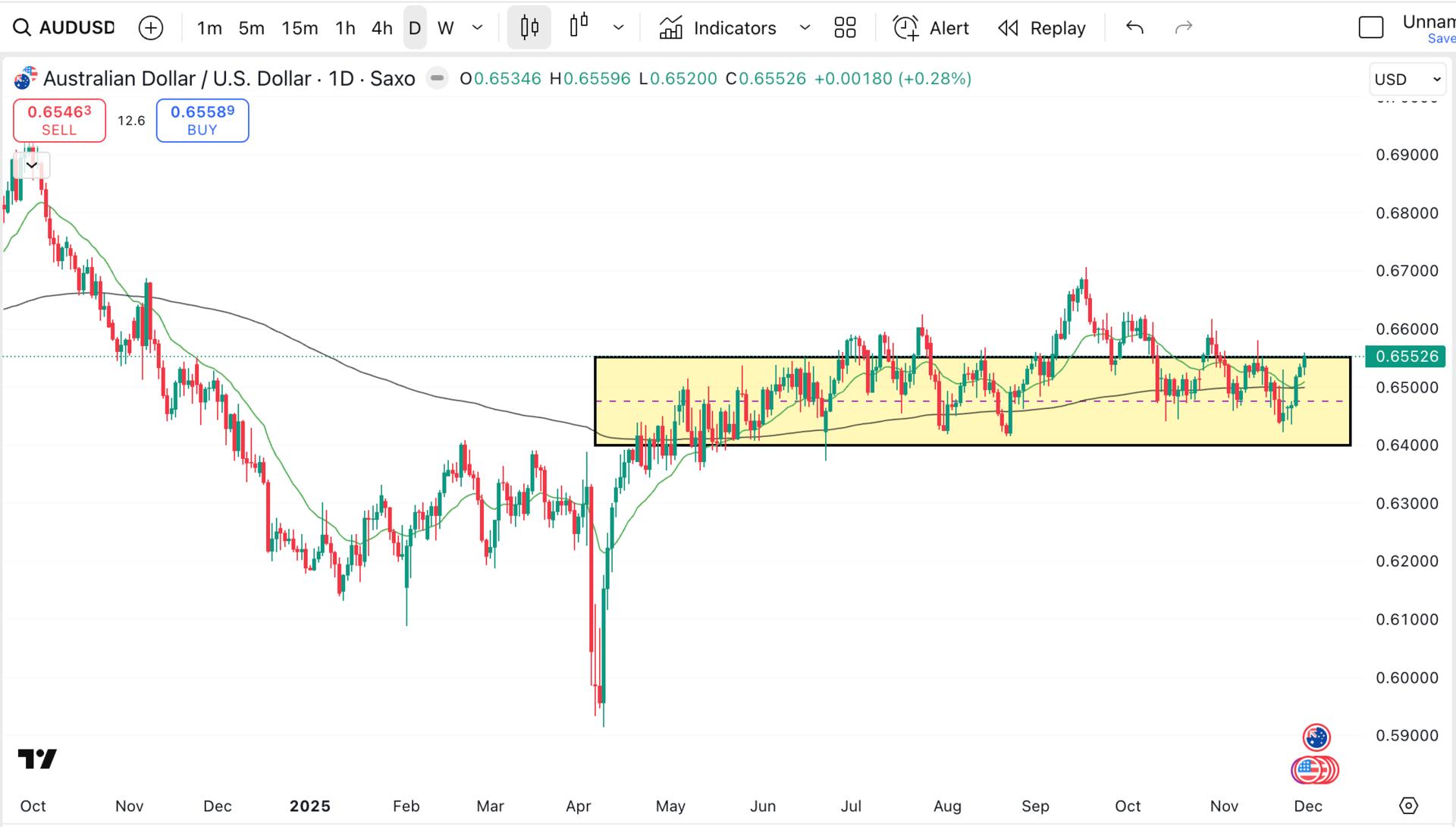

Why 0.6550 Matters

If you look at the daily chart, 0.6550 has been a ceiling for months. It has been tested again and again, and almost every time the pair has bounced back into the range.

Last week’s CPI helped the AUD lift into this zone again. The question now is whether GDP and the heavy US data calendar can give the pair the strength it needs to finally break out, or whether these events bring it back into the range.

This range has been the story of 2025 so far. The market has looked unsure about Australia’s outlook and equally unsure about the US. This week will help provide more clarity.

AUD/USD - Daily Chart

What Could Happen This Week

A Strong Australian GDP Reading

If GDP shows the economy is still holding up, the AUD may finally push through 0.6550. A strong number says the RBA can stay firm. Traders like that confidence and it attracts money into the currency.

Weak US Data

The US has a huge amount of data due this week. If it comes in soft again, the USD stays on the back foot. That combination of a weaker USD and a firmer AUD is usually enough to break through a stubborn level.

A Soft GDP or Strong US Data

If GDP misses or the US numbers surprise to the upside, the AUD could slip back into the range. The market has done that all year. Without a clear driver, it defaults back to the middle.

⸻

👉 Why This Move Matters in the Real World

A 2 percent lift in the AUD over the past 10 days might not sound like much, but for people dealing in large transfers it is significant.

Import and export businesses buying USD have had an easier week.

Sports tour companies paying for international travel in USD have seen a meaningful improvement.

Athletes or families converting money back to AUD have gained value.

Companies locking in forward contracts have had better pricing windows.

A two cent move on a six figure or seven figure transfer adds up fast. This is why understanding where we are on the chart helps you make smarter decisions. Technical levels give your triggers.

I will go deeper into hedging and forward strategy in tomorrow’s post.

It is a topic more people need to understand and it removes a lot of uncertainty for those with ongoing commitments.

Technical levels give your triggers.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X