The currency market dynamics have been completely reset this week following the US Federal Reserve’s move. As expected, the Fed delivered a 25 basis point (bps) rate cut, bringing the target range for the federal funds rate to 3.75%.

However, the real story lies not in the cut itself, but in the divergent policies of other major central banks, creating massive risk and opportunity across the G10 currencies.

The Three-Way Split

1. The USD: A Hawkish Cut

While the rate cut theoretically weakens the US Dollar (USD), its slide has been contained. Fed Chair Jerome Powell and the FOMC signalled a “hawkish cut,” hinting that the easing cycle may pause until the next quarter. This cautious stance, combined with the structural safety and robust US economic backdrop, prevents a major USD collapse. For our global readers, the USD remains the default currency for stability and a preferred holding vehicle against weaker emerging market currencies like the INR.

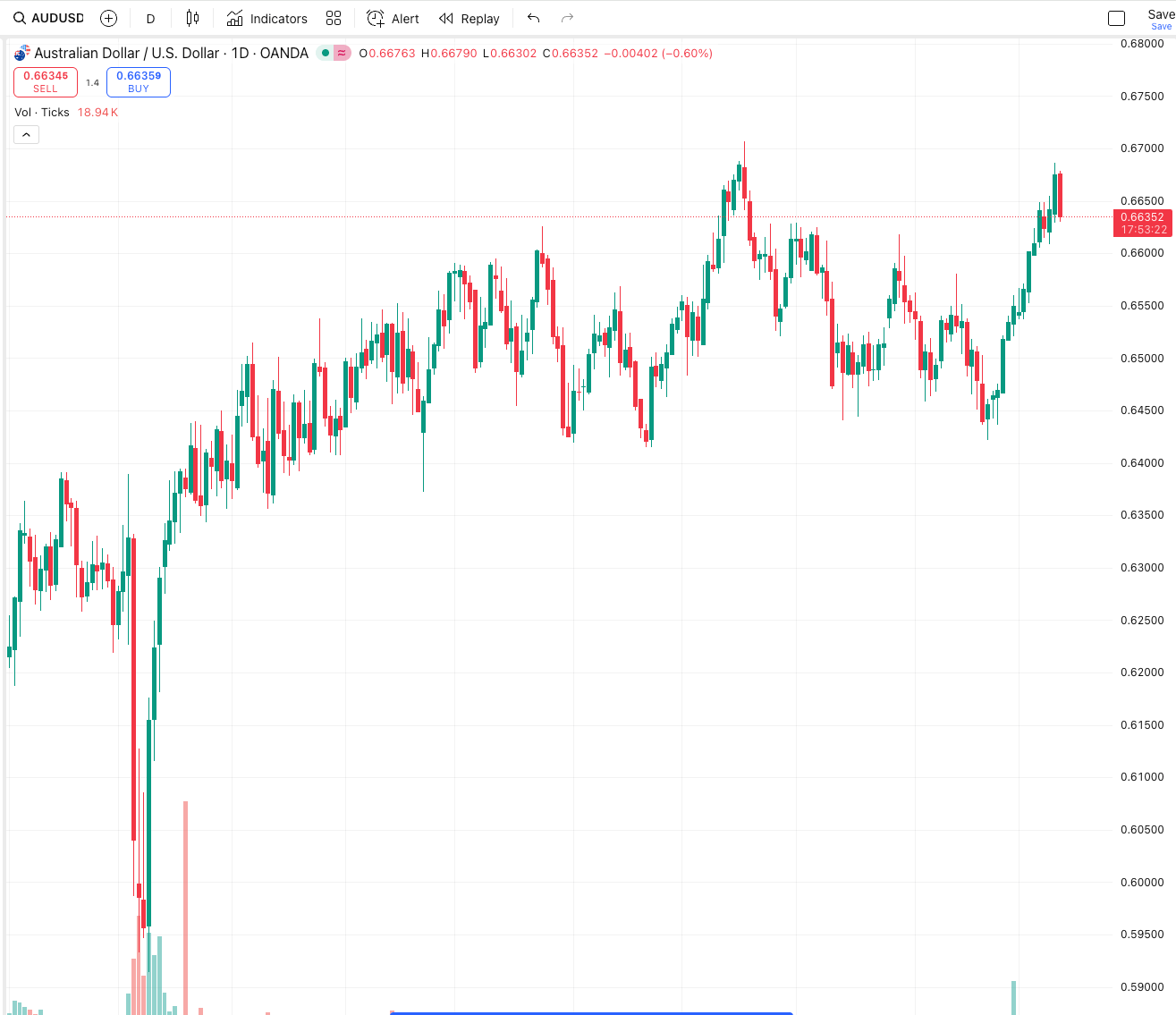

2. The AUD: The Outperformer

The Australian Dollar (AUD) is currently the strongest-performing G10 currency. The catalyst? The Reserve Bank of Australia (RBA) chose to hold its rate steady, but more importantly, its official statement highlighted persistent inflation risks and refused to rule out future rate hikes. This radically hawkish tone, in stark contrast to the Fed’s easing has caused the AUD to surge. This strength is directly driving up the cost for anyone paid in other currencies (like the Indian athlete in our lead story) when converting back to Australian dollars.

3. The JPY: The Rout Continues

The Japanese Yen (JPY) remains the global outlier. Despite a general softening in the US Dollar environment, the USD/JPY pair continues to surge, recently hitting a new monthly high around 155.68. This persistent weakness is a direct reflection of the market’s deep-seated distrust in the Bank of Japan’s (BOJ) ability to exit its ultra-loose policy stance. With the BOJ meeting next week, its extremely low interest rates continue to fuel the "carry trade," where investors borrow cheap JPY to buy higher-yielding currencies, keeping the Yen structurally weak.

Conclusion

This week confirms that global wealth management is no longer a simple bet on the US Fed. The significant policy divergence between the RBA's hawkish posturing and the BOJ's confusion is setting up major directional moves across all currency pairs. Whether you are repatriating an athletic salary, managing a foreign property sale, or planning an inheritance transfer, domestic central bank policy is now the single biggest factor dictating the final value of your money.

Why It Matters

A one or two cent move on a large contract can mean tens of thousands of dollars gained or lost. This week has the potential for fast moves in both directions. If you have an upcoming transfer, timing will matter.

Technical levels give your triggers. This week provides plenty to work with.

AUD/USD - Daily Chart

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X