Welcome back.

Last week, the Federal Reserve delivered the rate cut the market expected, and the headlines exploded. The S&P 500 hit a new milestone, and the general sentiment was one of relief and "risk-on."

But if your income, revenue, or business margins are tied to the global financial system—specifically to currency moves, the stock market index was the distraction.

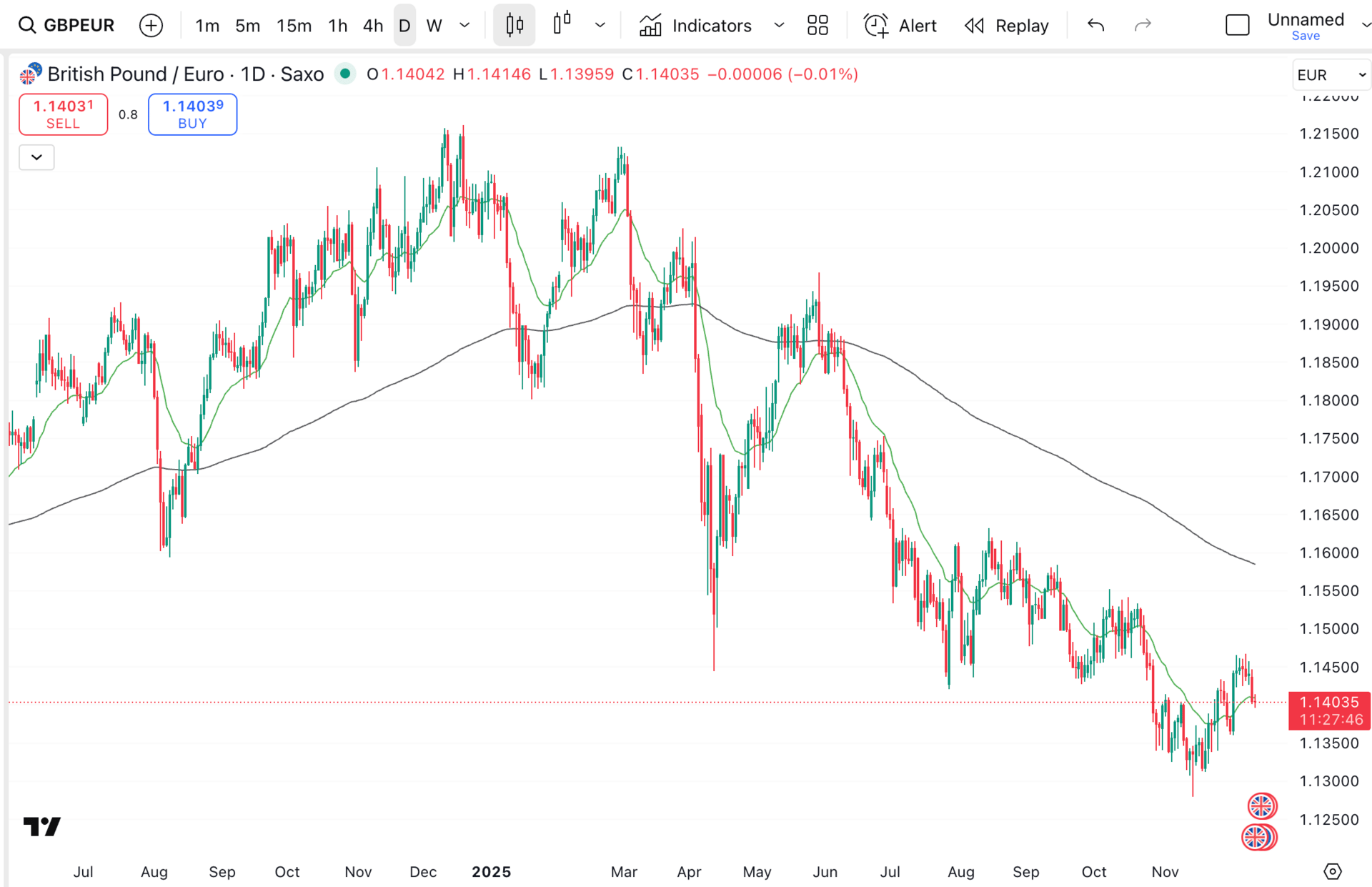

The real story for the week of December 15th is setting up to be a global volatility event driven by three major central banks. The number you need to watch is not the share price of a tech giant; it’s the shift in certainty, or lack thereof, in the GBP/EUR and AUD/JPY cross rates.

Last Week’s Lesson: USD Weakness is Confirmed

The key takeaway from the first half of December was simple: The era of aggressive interest rate hikes is definitively over, and the era of easing has begun.

The Fed cut the Federal Funds Rate by 25 basis points. While Chair Powell attempted to strike a balanced tone, the action confirmed what forward markets were pricing in: the US dollar is structurally headed toward a weaker position.

The Reaction: The USD fell broadly against most major currencies, which helped lift commodities and risk assets globally. This established a strong foundation for a "risk-on" finish to the year.

The RBA Stance: Meanwhile, the Reserve Bank of Australia (RBA) kept its cash rate steady at 3.60%, giving the AUD firm ground, particularly against the weakening USD.

This move sets the stage perfectly for what’s coming next: a true global test of monetary policy.

The Week Ahead: Central Bank Super Week

The week of December 15th is dominated by a trifecta of high-impact central bank meetings that will determine the final volatility profile of the year. This is where market certainty evaporates and preparation becomes your biggest advantage.

1. The Key Data Before the Storm (Tuesday, Dec 16th)

Before the central banks weigh in, we get a critical update on the US labour market with the Non-Farm Employment Change and the Unemployment Rate.

Why it Matters: The US labour market is showing signs of cooling. A surprisingly weak report on Tuesday will reinforce the market’s expectation for a faster pace of future Fed cuts. This will likely cause another sharp dip in the USD, fuelling the rally in GBP and EUR ahead of their own decisions.

2. The Thursday Showdown: BoE vs. ECB (Thursday, Dec 18th)

Thursday is the headline event, with the Bank of England (BoE) and the European Central Bank (ECB) both delivering policy decisions.

Bank of England (BoE): Markets are focused not just on the 4.00% expected rate decision, but on the MPC Official Bank Rate Votes. Any shift in the voting structure or a dovish lean in the Monetary Policy Summary will weigh heavily on the pound.

European Central Bank (ECB): The Main Refinancing Rate decision (2.15% expected) and the subsequent ECB Press Conference are critical. If the ECB expresses more optimism about the Eurozone economy than the BoE does about the UK, the GBP/EUR cross rate could see significant movement.

3. The Friday Policy Shock: Bank of Japan (BoJ)

The week concludes with the BoJ Policy Rate decision on Friday.

Why it’s a Risk: The BoJ has long maintained a highly accommodative stance. Any deviation—even a hint of shifting policy or cutting rates further—could trigger a sharp and immediate reaction in JPY crosses like AUD/JPY.

The Income Protection Lesson: Don't Hope, Hedge.

If you are running a business or receiving an income where your expenses are in one currency and your revenue is in another (e.g., you earn in AUD but pay suppliers in USD, or you earn in GBP but your mortgage is tied to EUR rates), this Central Bank Super Week is not a speculative event—it's an operational risk.

The core lesson is this: Rising volatility directly translates to rising uncertainty for your profit margins.

Do not rely on hoping that the BoE or ECB decision will fall in your favour. Hope is not a strategy. Protection is.

This is the exact environment where you need to be actively planting seeds about protecting your income and revenue streams.

Introducing Forward Contracts

This is why tools like Forward Contracts exist. A forward contract allows you to effectively lock in an exchange rate today for a transaction that will occur at a specific date in the future.

In a week of high uncertainty, a Forward Contract gives you certainty.

It protects your upcoming revenue from being wiped out by a sudden 2-3% market swing following an unexpected central bank announcement.

It allows you to budget and plan for the next three, six, or twelve months with a guaranteed exchange rate, safeguarding your profit margins.

The time to insure your house is not when the fire starts. The time to insure your income is not when the Central Bank decision is announced. It is now, when you can see the volatility brewing.

GBP/EUR - Daily Chart - Lowest since May 2023

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X