Monday Market Wrap: January 5, 2026

Welcome to the first full trading week of 2026. Markets have been jolted by a historic geopolitical shock over the weekend that is set to redefine risk appetites across the USD, oil, and safe-haven assets.

The "Black Swan" Headline: U.S. Intervention in Venezuela

A dramatic U.S. military operation on Saturday led to the capture of Venezuelan President Nicolas Maduro and his wife, who are now being held in a U.S. detention center. President Trump announced the U.S. will "run" the country through a transitional group until a secure transition occurs, with Secretary of State Marco Rubio overseeing the details.

Why it matters for your currency strategy:

USD Reaction: While the Greenback suffered its worst year in 2025 since 2017, this intervention could trigger a knee-jerk "flight to quality". However, long-term impact is uncertain as global dependence on the USD has been decreasing due to recent tariff regimes.

Oil and Energy: Venezuela holds the world’s largest crude oil reserves. Trump has promised that U.S. oil majors will invest billions to fix the country's broken infrastructure, which could eventually lead to a significant oil supply ramp-up in 5–7 years.

Safe Havens: Gold—which posted a nearly 70% rise in 2025—and silver are likely to see renewed speculative inflows as investors hedge against this sudden geopolitical instability.

Last Week’s Close & Weekly Performance

Last week was a volatile transition into the new year. Major pairs saw the following moves as of Friday's close:

Currency Pair | Closing Rate (Jan 2) | Weekly % Move | Story |

EUR / USD | 1.1716 | -0.24% | Slipped on weak Eurozone manufacturing PMI data. |

GBP / USD | 1.3450 | +0.12% | Consolidating after a strong 7.7% surge in 2025. |

USD / JPY | 156.95 | +0.85% | Edging higher as markets test the BoJ's tolerance for Yen weakness. |

USD / CAD | 1.3809 | +0.15% | Watching 1.3567 support; potential impact if U.S. pivots south for oil. |

What to Watch This Week (The Week Ahead)

It’s a massive week for data, with a heavy focus on the U.S. Labor Market.

Monday, Jan 5 (10:00pm): USD ISM Manufacturing PMI. Expected to stay in contraction territory at 48.3.

Wednesday, Jan 7 (7:30am): AUD CPI y/y. A key read for the Aussie Dollar, forecasted at 3.7%.

Wednesday, Jan 7 (8:15pm - 10:00pm): ADP Employment (47K forecast) and JOLTS Job Openings (7.65M) will provide early clues on the U.S. job market health.

Friday, Jan 9 (8:30pm): The Big One—Non-Farm Payrolls (NFP). Forecasted at 57K (down from 64K). Combined with the Unemployment Rate (forecasted at 4.5%), this will dictate USD strength for the rest of the month.

Consultant's View: The "Silent Pay Cut" Risk

The Venezuela news adds a layer of "Headline Risk" that traditional banks aren't equipped to manage for you. Geopolitical shocks like this typically cause sharp, erratic swings in the USD.

If you are an athlete or professional earning in USD, this is the week to be proactive. Geopolitics is back as a primary market driver—don't let a weekend headline erode your contract value.

Ready to protect your income from this week's volatility? Let's discuss a strategy for your next transfer.

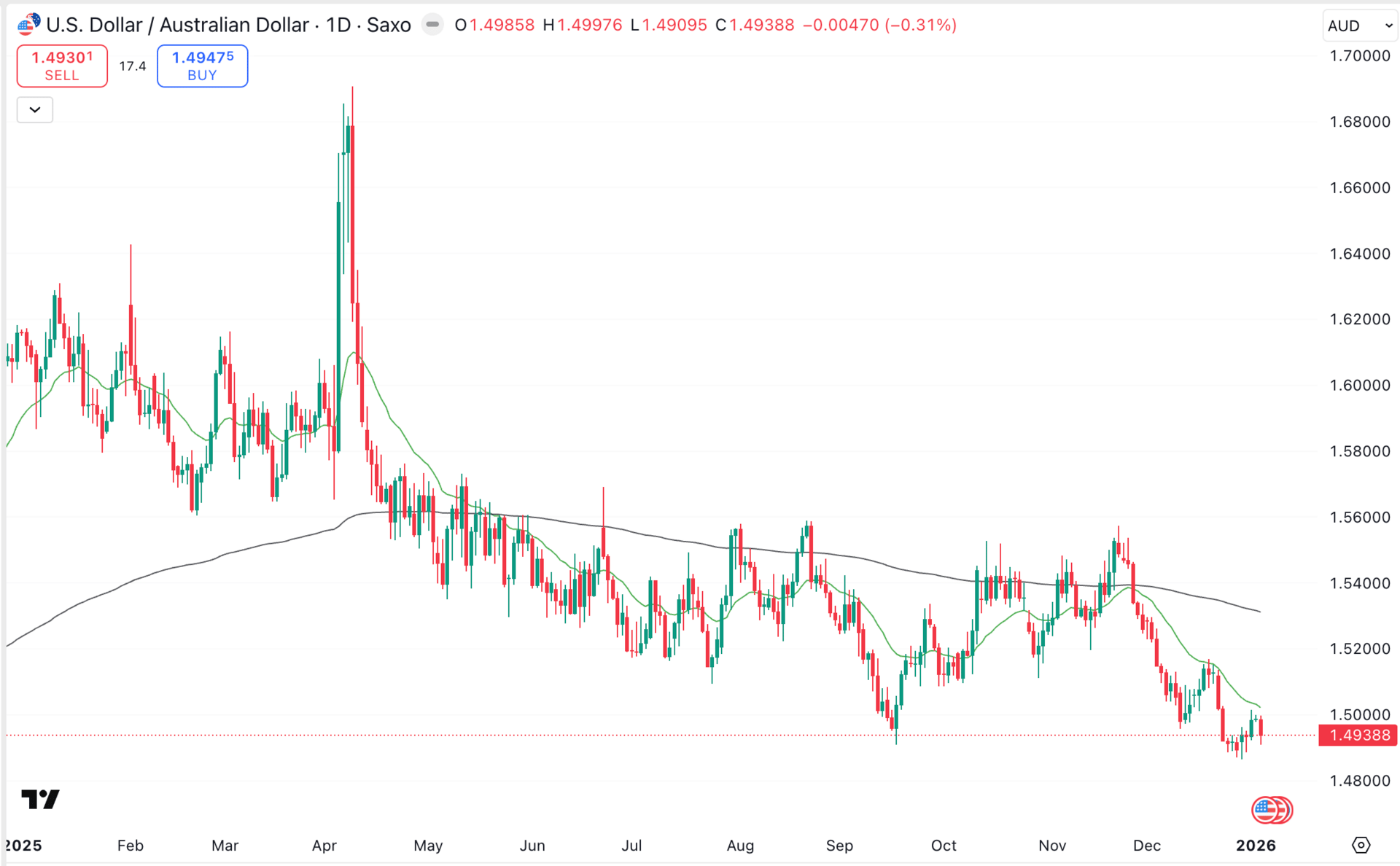

USD/AUD - Daily Chart

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X