As the global markets enter the final trading week of 2025, the usual "holiday lull" has been replaced by surprising volatility in the Asian session. While major financial hubs saw reduced volumes due to the proximity of Christmas and New Year’s Day, traders are already positioning for the macro landscape of 2026.

Last week’s data set a complex stage: the US saw mixed signals with a lower-than-expected CB Consumer Confidence reading (89.1) and a softening in Durable Goods.

However, the USD remains a dominant force as global trade tensions persist and "safe-haven" flows into assets like Gold—which recently breached the historic $4,500/oz mark—continue to dictate sentiment.

Currency Overview & Recent Performance

USD (US Dollar)

The Greenback remains the anchor of the FX market. Last week, US Unemployment Claims came in better than forecast at 214K, reinforcing the "higher-for-longer" narrative regarding interest rates. While the upcoming week is light on Tier-1 data, the market is bracing for Wednesday’s FOMC Meeting Minutes. Traders are looking for any hints of a hawkish tilt for Q1 2026.

Last Week’s Move: Gained ground against the JPY and CAD but showed slight weakness against the surging AUD and EUR.

GBP (British Pound)

The Pound is currently enjoying a period of relative stability, benefiting from a weaker Euro on the crosses and a general appetite for yield. GBP/USD is currently holding around the 1.3508 level. Without significant UK data on the calendar this week, Sterling's performance will be largely dictated by external Dollar strength and broader risk sentiment.

Last Week’s Move: GBP/USD moved higher (+0.5% approx.) as it capitalised on the softening of US yields toward the end of the week.

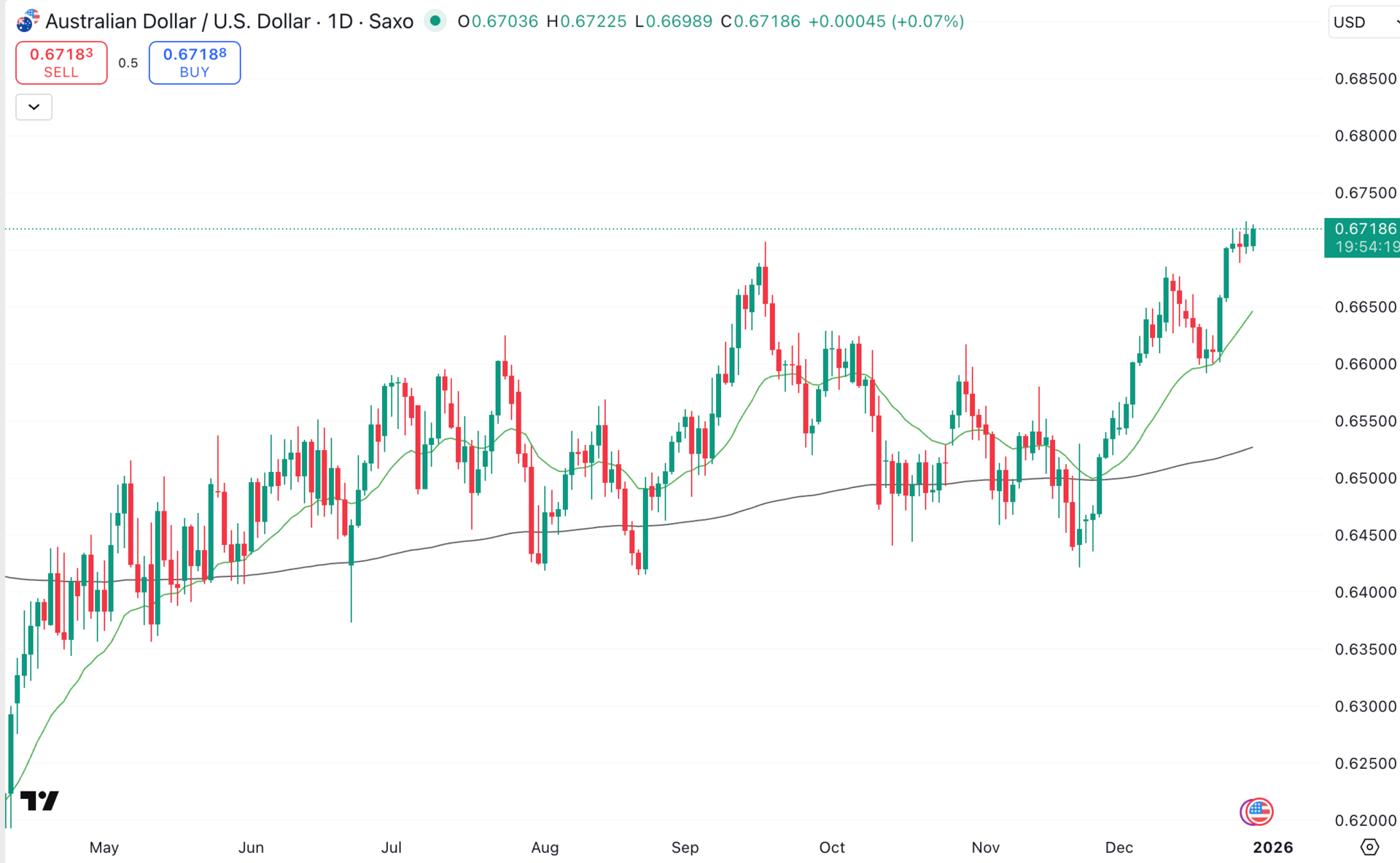

AUD (Australian Dollar)

The Aussie is the standout performer, perched near its 2025 highs. This strength is driven by a double-barrelled rally: climbing domestic bond yields and soaring commodity prices. As China’s Manufacturing PMI looms (forecast at 49.4), AUD traders are watching closely to see if the regional powerhouse can provide a catalyst for a breakout above psychological resistance levels.

Last Week’s Move: Appreciated significantly, buoyed by the "commodities super-cycle" narrative and a hawkish outlook for the RBA.

JPY (Japanese Yen)

Despite expectations of a BoJ pivot, the Yen remains depressed. Today’s BoJ Summary of Opinions suggested that while inflation is rising, the central bank is in no rush to aggressively hike in January. This "less-hawkish-than-hoped" tone saw USD/JPY push back toward 156.33. Governor Ueda’s recent speeches have failed to provide the "floor" the Yen desperately needs.

Last Week’s Move: Weakened against most majors as the interest rate differential between Japan and the rest of the world remains wide.

EUR (Euro)

The Euro is caught in a tug-of-war. While it is gaining against the Dollar (trading near 1.1784), it is struggling on key crosses like EUR/CAD. The Eurozone faces a quiet end to the year, with traders primarily focused on whether the ECB will signal a more aggressive easing cycle in the face of stagnant growth projections for 2026.

Last Week’s Move: Found support against the USD but remains under pressure against the commodity-linked currencies (AUD/CAD).

The Week Ahead

Liquidity will remain thin as we approach the January 1st holiday. However, Wednesday represents a "mini-volatility" window with the release of the FOMC Minutes and US Unemployment Claims. Until then, expect the market to be driven by technical flows and year-end rebalancing as institutions lock in 2025 profits.

AUD/USD - Daily Chart - Moved to it’s highest point since October 2024

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X