Welcome back! After a quiet start to the year, the financial markets are officially back to business.

This Monday, we face a bit of a "split" market: while the rest of the world is moving, the US is observing Martin Luther King (MLK) Day. This means US stock and bond markets are closed, typically leading to lower trading volumes and "quieter" price action during the afternoon sessions.

Here is your Monday Market Wrap to get you up to speed.

The Big Picture: Geopolitics & "The Catch-Up"

The biggest story of early 2026 remains the massive geopolitical shift in South America following the US intervention in Venezuela and the capture of Nicolás Maduro. This has sent shockwaves through energy markets and is forcing investors to rethink risk in emerging markets. Closer to home, financial agencies are still playing "catch-up," releasing a flood of economic data that was delayed by last year's government shutdown.

Main Pairs: What’s Moving?

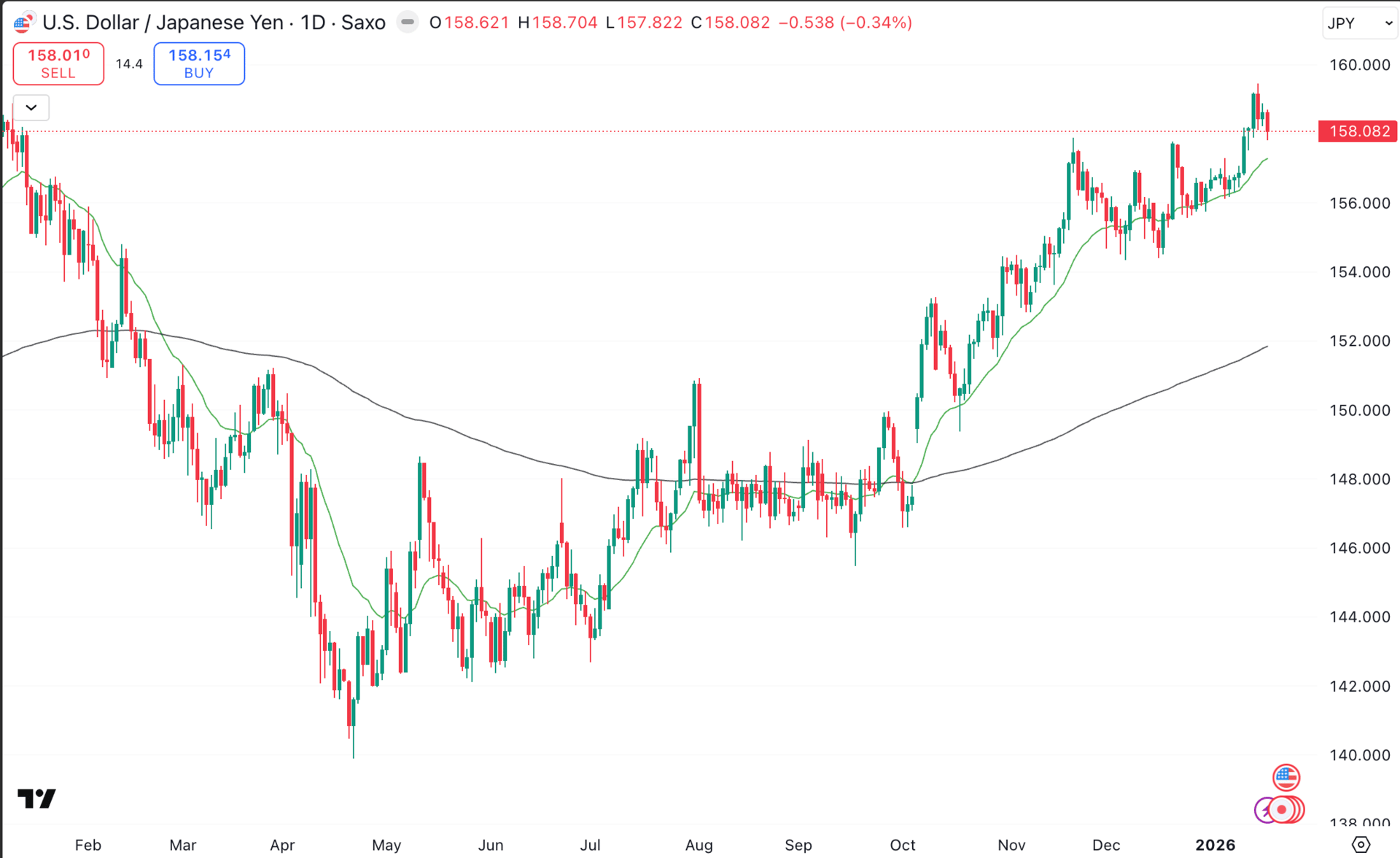

1. USD/JPY: The "BOJ Friday" Watch

Current Rate: ~158.08

The Outlook: All eyes are on the Bank of Japan (BOJ) this Friday. While they aren't expected to change their interest rate just yet (keeping it below 0.75%), traders will be dissecting their "Outlook Report" for any hint of when they might finally push rates higher.

Educational Tip: When a central bank (like the BOJ) hints at raising interest rates, its currency usually gets stronger. Because the BOJ has kept rates so low for so long, any small "hawkish" (aggressive) hint could cause a big move in the Yen.

USD/JPY - Daily Chart

2. GBP/EUR: The "Holding Pattern"

Current Rate: ~1.1536

The Outlook: It is a busy week for the UK, with inflation (CPI) data due Wednesday and Retail Sales on Friday. Meanwhile, the European Central Bank (ECB) is also in the spotlight, with President Lagarde speaking several times this week.

Educational Tip: If UK inflation comes in "hotter" (higher) than expected, it might force the Bank of England to keep interest rates high for longer, which typically supports the Pound (GBP).

3. EUR/USD: Policy Divergence

Current Rate: ~1.1598

The Outlook: The Euro is currently under pressure, dipping below the 1.1600 mark. Stronger-than-expected US data has pushed back hopes for early Fed rate cuts, keeping the US Dollar strong.

Educational Tip: This is "Policy Divergence" in action. If the US economy stays strong while Europe's slows down, the US Dollar usually gains value against the Euro because investors prefer to park their money where growth is higher.

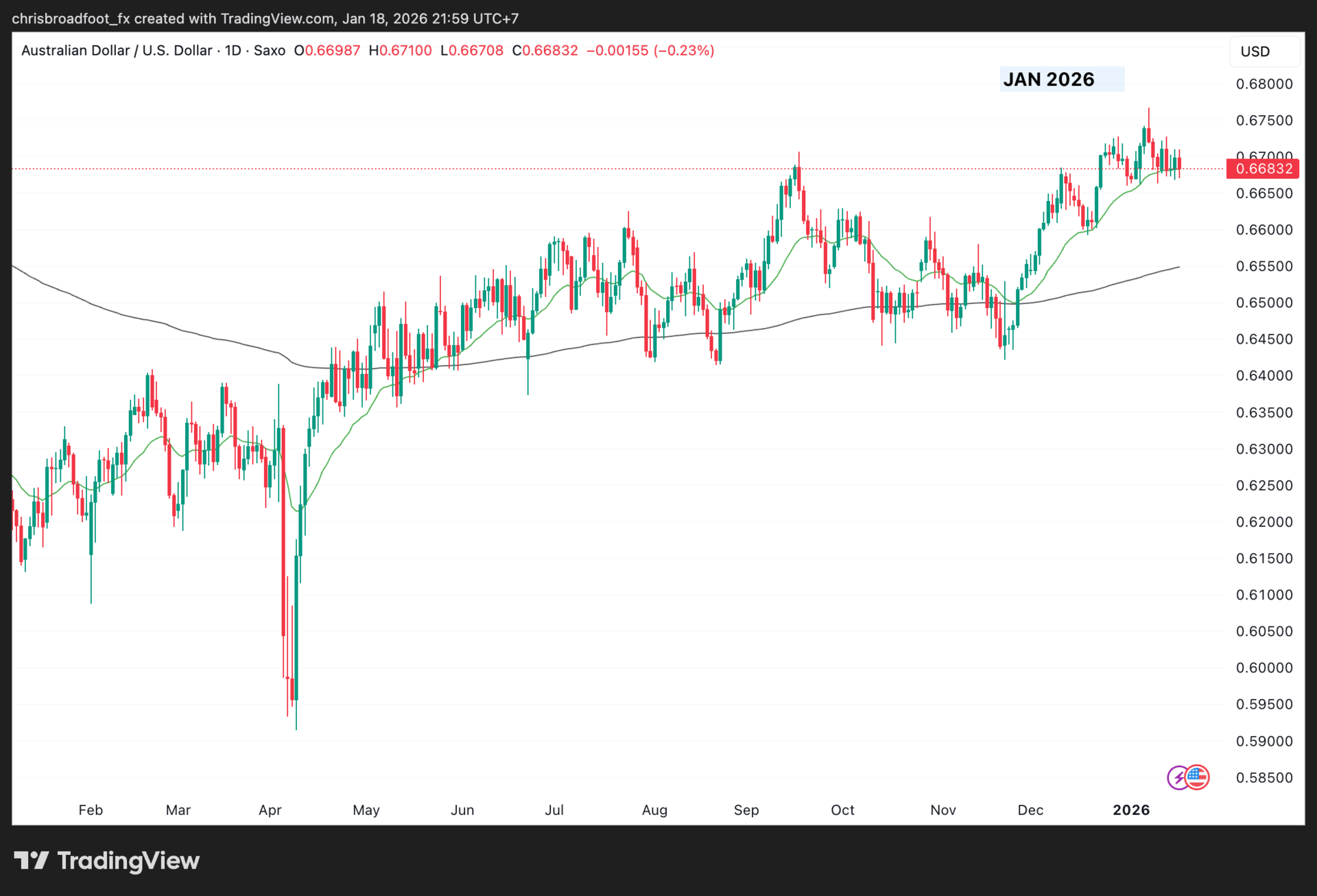

4. AUD/USD: The Jobs Report

Current Rate: ~0.6683

The Outlook: Australia has a massive "Jobs Thursday" coming up. After a surprise drop in employment last month, markets are looking for a rebound of about 20,000 jobs.

Educational Tip: The "Aussie" is often seen as a "risk-on" currency. When the global economy feels positive and job markets are growing, the AUD tends to rise. If the jobs data is weak, it could signal that the Reserve Bank of Australia (RBA) will stay on the sidelines.

AUD/USD Daily Chart

The Week Ahead: Key Events

Monday: China Q4 GDP (Expected to slow to 4.6%).

Tuesday: UK Jobs data & World Economic Forum (Davos) begins.

Wednesday: UK Inflation (CPI) & President Trump speaks in Davos (focusing on housing).

Thursday: US "catch-up" data (GDP & PCE Inflation) & Australia Jobs.

Friday: Bank of Japan Policy Decision & Eurozone Manufacturing data.

Summary: We are moving from a quiet holiday period into a week packed with "real" data. With the US on holiday today, expect some "choppy" or thin trading, but keep your eyes on the Wednesday/Thursday data dump—that is when the real trends for the month will likely be set.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X