The past ten days have given the Australian Dollar a solid lift. A 2 percent move might feel small, but for businesses, sports tour operators, and anyone paying invoices in USD this shift can make a meaningful difference to margins. These small windows are where planning beats guessing.

Today’s post is about how to use the current range to your advantage and how to plan for the next three to twelve months by protecting your downside with simple tools.

Why a 2 Percent Move Matters

When you operate in international markets, the difference between a good rate and an average rate adds up quickly.

Here is what a 2 percent swing means in real terms:

A business paying a $250,000 USD supplier invoice sees a change of about $7,000 AUD

A sports tour company booking US hotels, flights and competition fees sees margins shift overnight

Clubs or academies booking international travel months in advance can lose or gain thousands simply based on timing

This is the part many businesses and operators overlook. Currency moves quietly in the background, and then one day the rate shifts a few cents and the cost of doing business changes instantly.

Your planning needs to account for this.

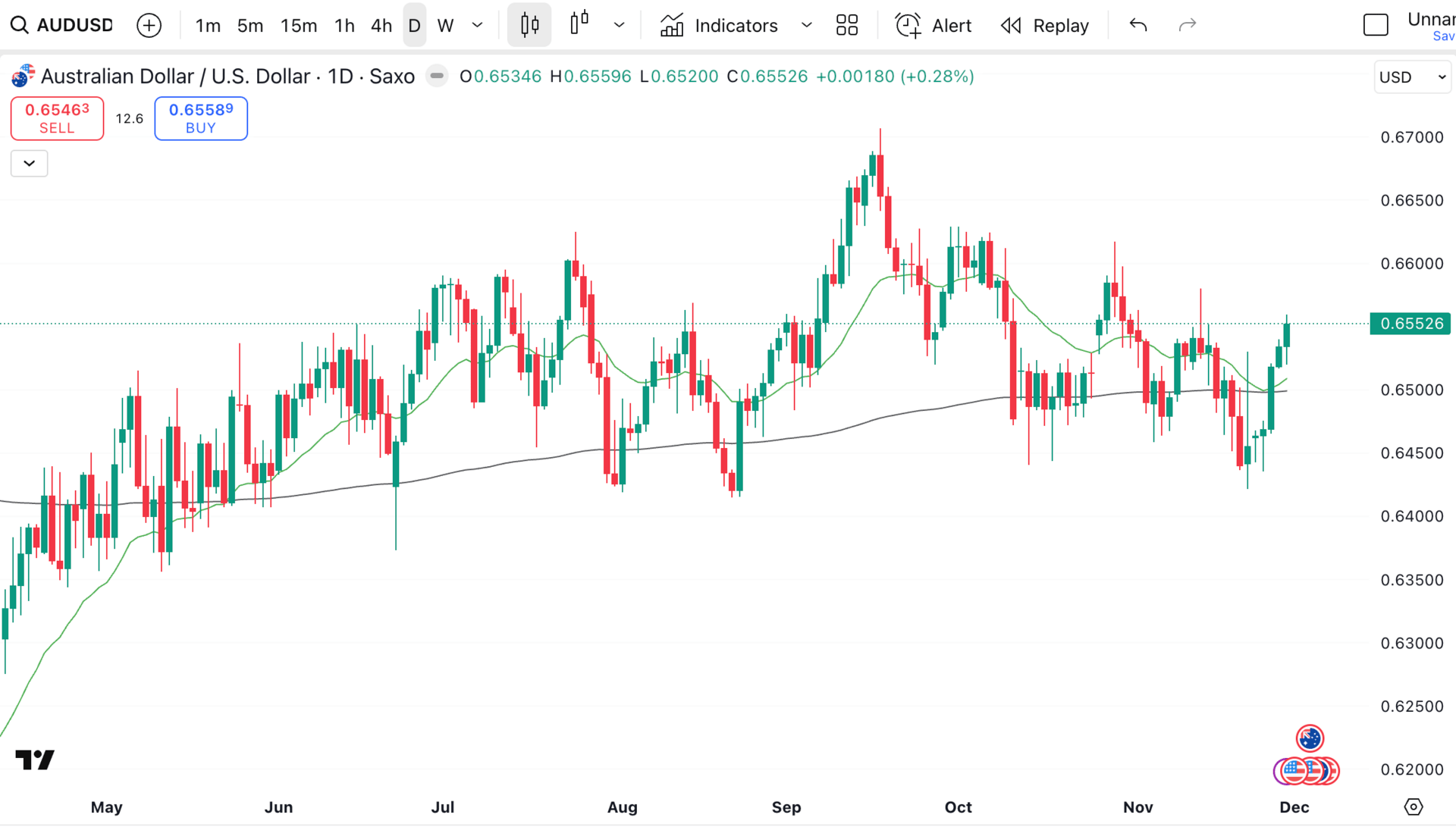

The AUD/USD Range and What It Means for Planning

The AUD has now spent close to three months inside a tight 3 percent range.

When a pair sits still this long, it gives businesses clarity. You can see the top side of the range. You can see the bottom. You know roughly where your worst case and best case fall.

Now we are back toward the higher end of that range after the CPI lift.

That creates opportunity.

Most people wait for the absolute top before acting. The problem is that the market rarely rewards those who wait. It rewards those who plan early and remove uncertainty.

How a Forward Contract Helps You Plan

A forward contract is one of the simplest tools available.

It lets you lock in today’s rate for a future payment.

You don’t need to guess the market.

You don’t need to stress about the next US data release.

You secure a number and build your budget around it.

Here is the simple version of how it works:

You know you have USD payments coming up in 3 to 12 months

You lock in a rate today for those future payments

Your cost becomes fixed instead of floating

You protect your margin against sudden drops in the AUD

If you only want to secure part of your exposure, you can lock in a percentage

It is not about trying to beat the market.

It is about removing uncertainty and keeping your budget intact.

Do You Need to Lock in Everything? No.

One of the biggest misconceptions is that a forward contract means committing all of your future exposure. That is not how most smart operators use it.

The better approach is:

Lock in a portion at favourable levels

Leave the rest open to take advantage of any further upside

This gives you protection and flexibility.

It also keeps your CFO, accountant, board or business partner happy because your worst case is covered.

Right now, AUD/USD is in the higher part of its three month range.

This does not guarantee a breakout.

But if you know you have USD payments coming up, this is a sensible place to consider locking in part of your exposure.

Technical levels give your triggers.

The market is giving you one right now.

Why This Matters for Sports Tour Companies

Sports tours often book USD expenses months before the trip.

Accommodation, tournament fees, team logistics, internal flights.

These costs are fixed in USD long before you actually convert the AUD.

If the rate drops suddenly, the business eats the cost.

A forward contract removes that risk.

You can lock in today’s higher levels for commitments spread across the next year.

This protects your margin and gives families, players, and the organisation confidence in what they will be paying.

This is how professional operations manage their exposure.

It is calm, planned, and predictable.

Final Thoughts

The AUD has lifted 2 percent in ten days and is now sitting at an important level.

Whether you run a business, a sports program, a club, or a tour company, these are the moments to make decisions, not guesses.

You don’t need to lock in everything.

But locking in something at the higher end of the range strengthens your position for the next three to twelve months.

If you want to explore how a forward contract could fit your situation, or you need a clearer plan for international payments, you can join the newsletter below or book a call with me directly.

Smart decisions build your advantage.

This is one of them.

AUD/USD - Daily Chart

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X