The "Sell America" Trade: Decoding the 2026 Dollar Slide

If you feel like the financial ground is shifting beneath your feet this week, you’re right. We are witnessing a rare "Coordinated Intervention" in the currency markets that hasn't been seen at this scale since the late 90s.

The target? A weaker US Dollar.

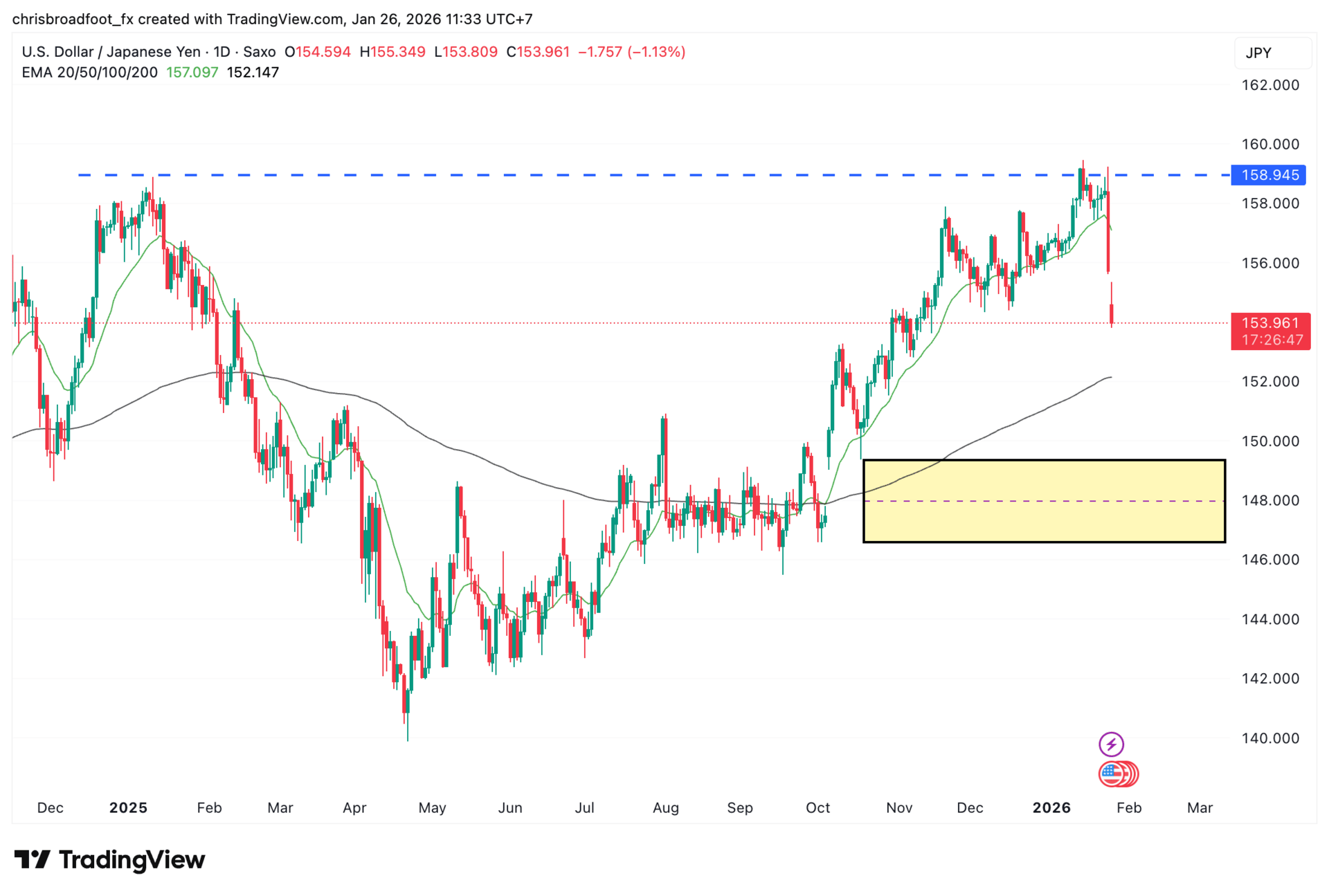

The "Secret" Fed Operation On Friday, the New York Fed conducted what is known as a "Rate Check" on the USD/JPY. In the high-stakes world of FX, this is the formal "warning shot" before the Fed actively starts selling Dollars to prop up the Japanese Yen.

The US is essentially sacrificing Dollar strength to rescue Japan (its largest holder of US Treasuries) from a "death spiral."

The Perfect Storm for the Greenback: This intervention isn't happening in a vacuum. There are three massive "weights" currently pulling the Dollar down:

The Trump "Weak Dollar" Doctrine: The administration has been clear—a weaker Dollar is the key to boosting US manufacturing. By making American goods cheaper globally, they hope to slash the trade deficit.

The Fed Independence Risk: Speculation is mounting that the next Fed Chair may be more "dovish" (prone to lower interest rates), leading to a "Sell America" sentiment as investors move money out of US assets.

The Return of the Printing Press: With the "One Big Beautiful Bill" (OBBBA) and growing fiscal deficits, the market is pricing in more liquidity (QE). When you print more money, the value of each individual Dollar drops.

USD/JPY - Daily Chart - Selling off from the 2025 highs

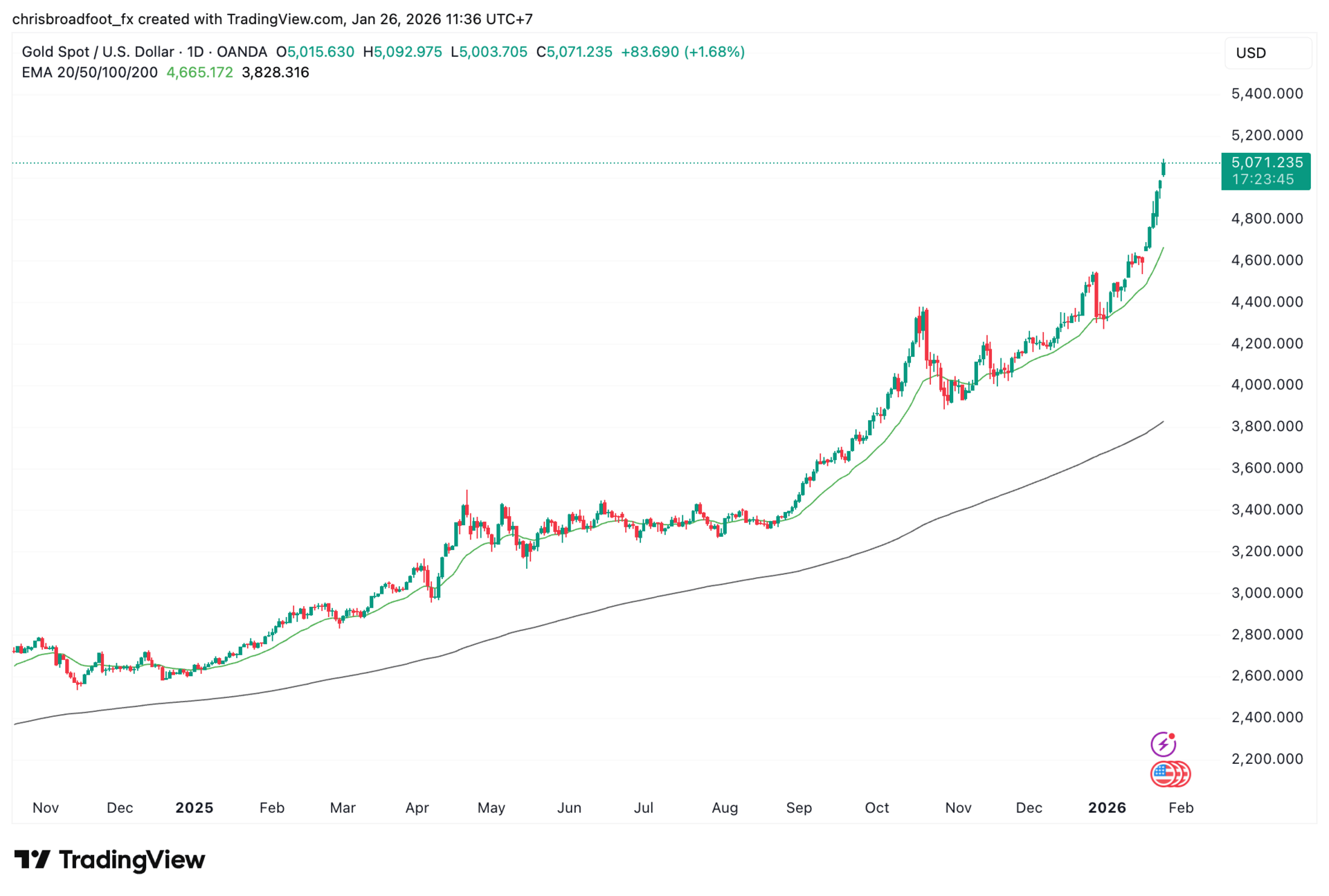

The $5,000 Gold Signal 🏆 Gold just hit an all-time high of $5,078/oz. This is the ultimate "Canary in the Coal Mine."

When Gold rips higher while the Dollar is being actively sold by its own Central Bank, it tells us that big institutional money is hedging against currency debasement. They are moving out of "paper" and into "hard assets."

Gold v USD - Daily Chart - All time high after all time high

Why this matters for 2026: We are moving away from a decade of "Dollar Dominance" into a more volatile, balanced exchange era. The rules of the game have changed: intervention is no longer a response to a crisis; it is now a proactive political tool.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram