Tonight’s data is important.

The US releases PPI and Core Retail Sales, two indicators that sit right at the heart of how strong the American economy really is.

These numbers directly influence expectations around inflation, consumer strength, and the Federal Reserve’s interest rate path. And all three feed into one outcome. USD direction.

Here’s the clear breakdown.

1. PPI: The Early Inflation Signal

PPI measures what producers are paying for goods and services. It often moves before CPI, which makes it a leading indicator for inflation trends.

If PPI comes in higher than expected:

• Signals inflation pressures are still present

• Fed may stay cautious about cutting rates

• USD strength increases as yields rise

• Markets shift back toward a “higher for longer” view

Outcome. USD gets a boost.

If PPI comes in lower than expected:

• Shows inflation is easing

• Fed could accelerate rate-cut expectations

• Lower yields weaken USD

• Risk sentiment improves globally

Outcome. USD softens.

2. Retail Sales: The Backbone of the US Economy

Retail Sales show how Americans are spending. The US consumer drives roughly 70 percent of the economy. That means this release has real weight.

If Retail Sales beat expectations:

• Confirms the US consumer is still strong

• Supports the idea that the US economy can outgrow the rest

• Fed stays patient on any rate cuts

• USD strengthens as growth outlook improves

This keeps the USD as the preferred safe, high-yield currency.

If Retail Sales miss expectations:

• Signals the consumer is slowing

• Growth expectations are revised lower

• Yields drop as markets price in more cuts

• USD weakens across the board

This gives other currencies breathing room.

3. The Combined Impact

Tonight is one of those sessions where both numbers together create the real story.

Bullish USD Scenario

PPI higher + Retail Sales stronger

• USD rallies

• Yields jump

• Risk currencies struggle

• Global markets lean back toward USD as the anchor

Bearish USD Scenario

PPI softer + Retail Sales weaker

• USD pulls back

• Yields soften

• Markets shift toward risk currencies

• Fed cut expectations grow quickly

Mixed Scenario

One strong. One weak.

• USD chops around

• Traders wait for Wednesday’s US data to confirm direction

• No major trend until a second data point aligns

This is common. One print rarely drives the whole week on its own unless the deviation is big.

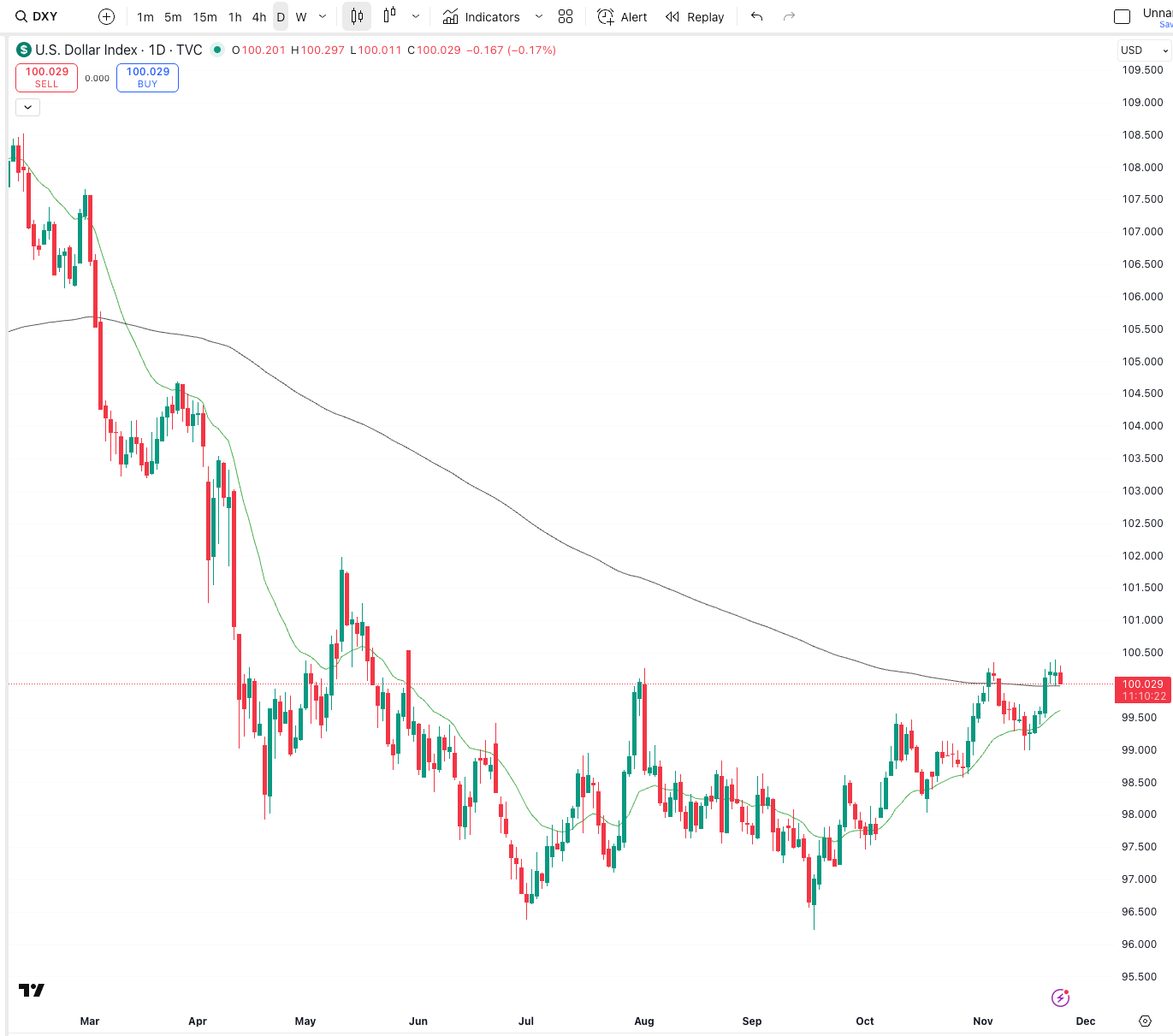

DXY - US Dollar Index - Daily Chart

Why This Matters For You?

If you earn or hold USD.

A stronger print increases your buying power.

A weaker print means acting faster makes sense.

If you need USD.

A softer print gives a short window to buy USD at better levels.

This is why we follow the data.

This is why technical levels give your triggers.

And this is why planning transfers around key announcements protects your income.

If you want help setting up limit orders or a forward strategy based on tonight’s outcomes, reach out anytime.

👉 Book a call

👉 Join The Currency Advantage Weekly

👉 Watch full chart breakdowns on YouTube

👉 Follow me on Linkedin

👉 Follow me on Instagram