I want to walk through a real EUR/AUD example from the past few months, because the chart tells the story better than any sales pitch ever could.

In October, I was introduced to a client with €230,000 to convert into AUD.

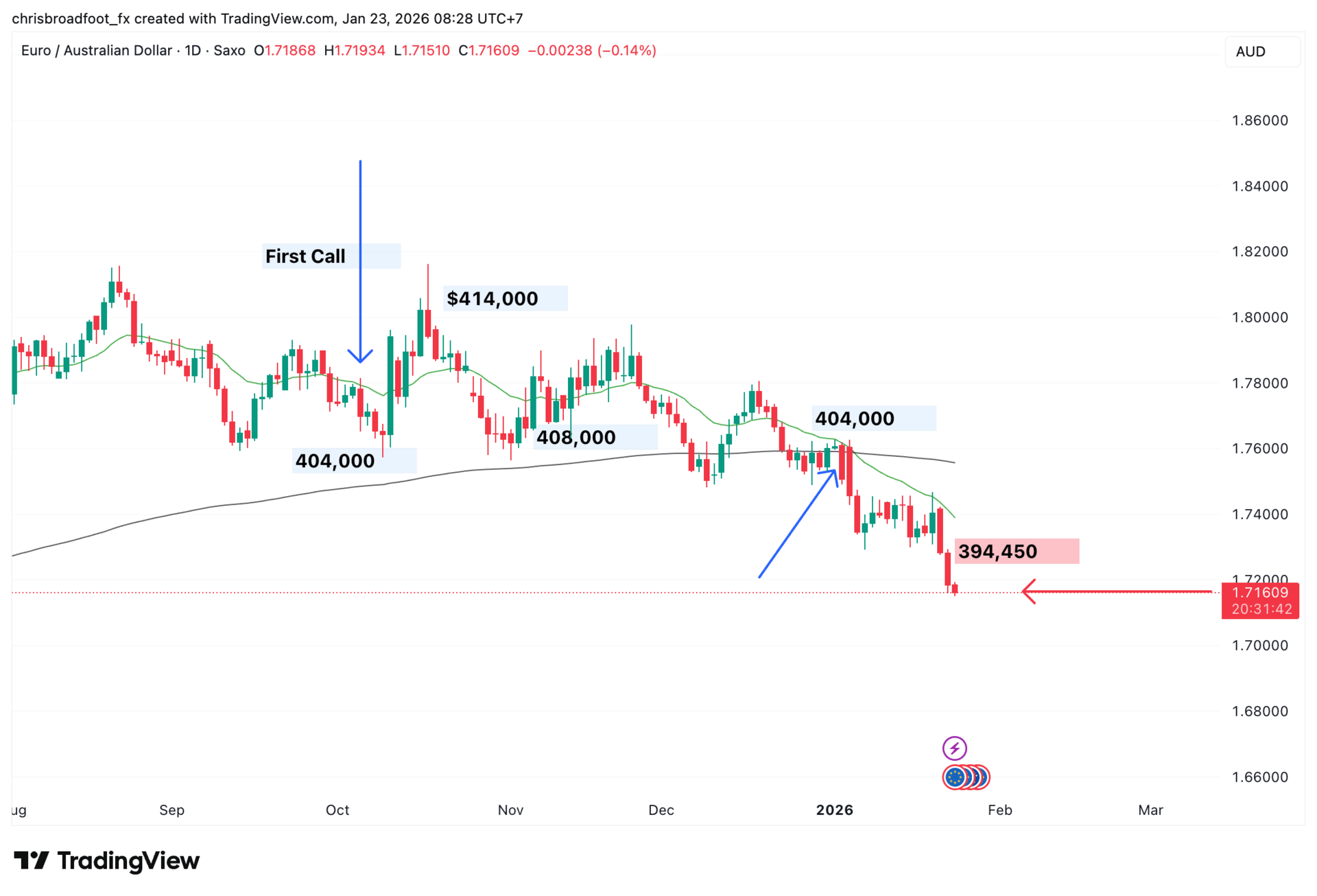

At the time of our first call, that exposure was worth around $404,000 AUD. You can see that level clearly on the chart.

We spoke through where the market was sitting, what other FX providers would likely offer, and what mattered more than the headline rate. Timing and risk.

The client quite reasonably wanted to compare providers.

Shortly after that first conversation, the market spiked.

That same €230,000 was briefly worth around $414,000 AUD.

That spike is marked clearly on the chart.

I reached out and flagged it. No pressure. Just awareness.

He was busy, thanked me for the update, and said he would come back to it.

A few weeks later, while he was still comparing options, the market had eased back to around $408,000 AUD. Still a strong level. Still above where we started.

Then, at the start of January, something more important happened.

EUR/AUD broke below the 200-day moving average, the long-term black line on the chart. This is not a short-term indicator. When price holds below this level, it often signals a shift from range to downtrend.

I reached out again and explained my concern. Not as a prediction, but as a change in risk.

Three weeks later, the market did exactly what trends often do once that level breaks.

Today, that same €230,000 is worth approximately $394,450 AUD.

From the peak to now, that is close to a $20,000 AUD difference.

This is the uncomfortable part of the conversation.

The original comparison being made was between FX providers who may have differed by $600 to $800 AUD.

That focus on squeezing a slightly better margin came at the cost of missing:

A multi-week high

A clear warning signal when trend support broke

The chance to remove risk when the odds were favourable

Now the question becomes much harder.

Do you act now and lock in a lower level?

AUD/USD - Daily Chart

Or do you wait and hope the market comes back?

And what if it doesn’t?

This is why I work the way I do.

I don’t claim to pick tops or bottoms.

I don’t promise perfect timing.

What I do is:

Flag spikes and multi-week or multi-month highs

Explain when key technical levels break

Help clients understand when risk is increasing

Focus on protecting value, not undercutting competitors by a few points

After 11 years of watching these scenarios play out, one thing is consistent.

Inaction is still a decision.

And hoping is not a strategy.

If you have a large currency exposure coming up and want an experienced view on timing and risk, that conversation usually matters far more than finding the cheapest rate on the day.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X