It has been a busy session across global FX. Several major currencies reacted to central bank signals, budget announcements, and shifting expectations around the next Federal Reserve move.

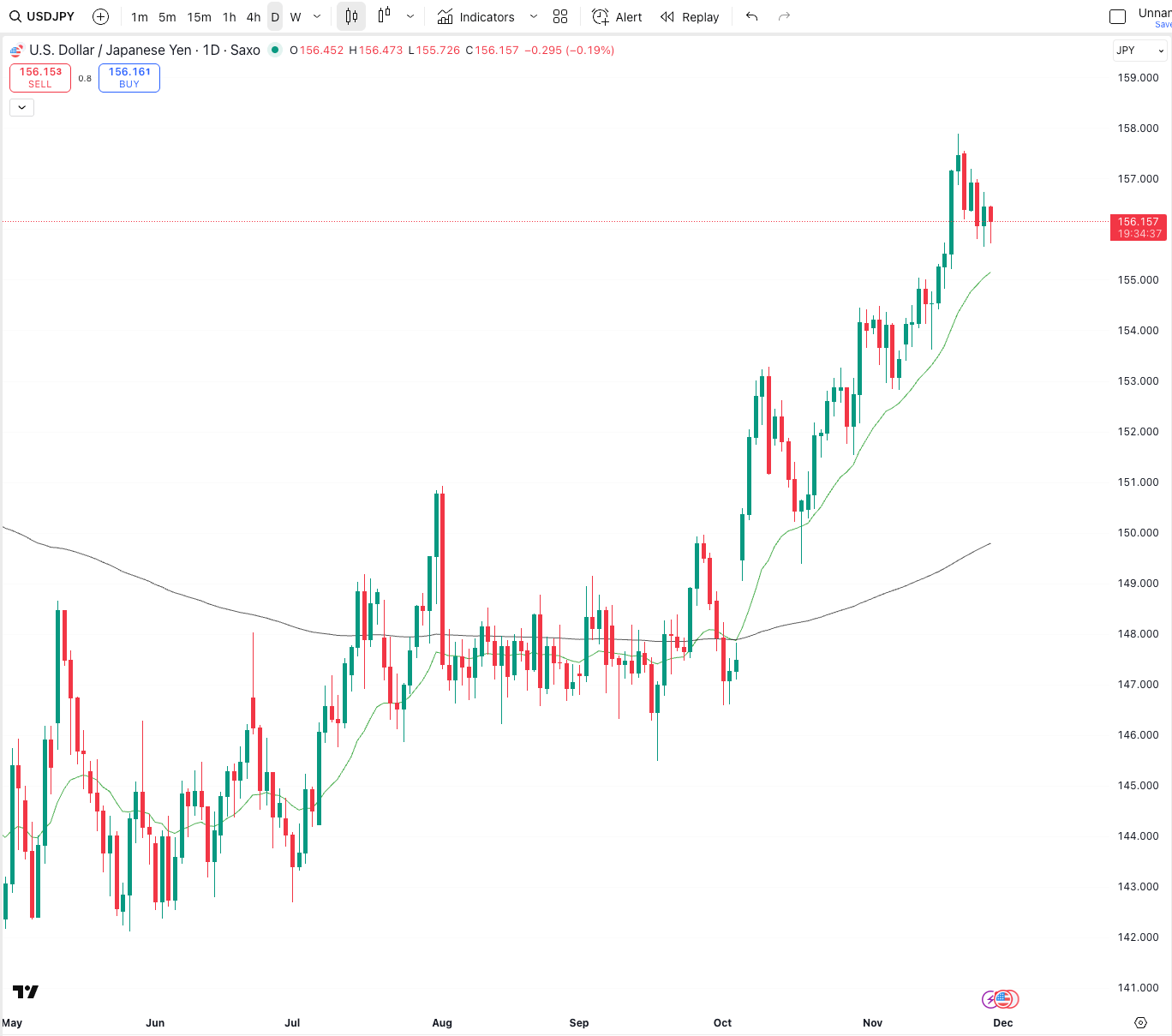

JPY Focus

The yen opened stronger on reports that the Bank of Japan may hike rates as early as next month. That initial reaction faded quickly as traders questioned whether a single hike would be enough to shift the broader trend.

USDJPY moved from 155.66 to 156.44, with investors still watching for possible intervention.

Rate differentials remain wide and Japan’s fiscal outlook continues to worry markets. A hike will only matter if the BOJ signals a consistent path of tightening through 2026. Without that, yen strength is likely to be short lived.

USD/JPY - Daily Chart

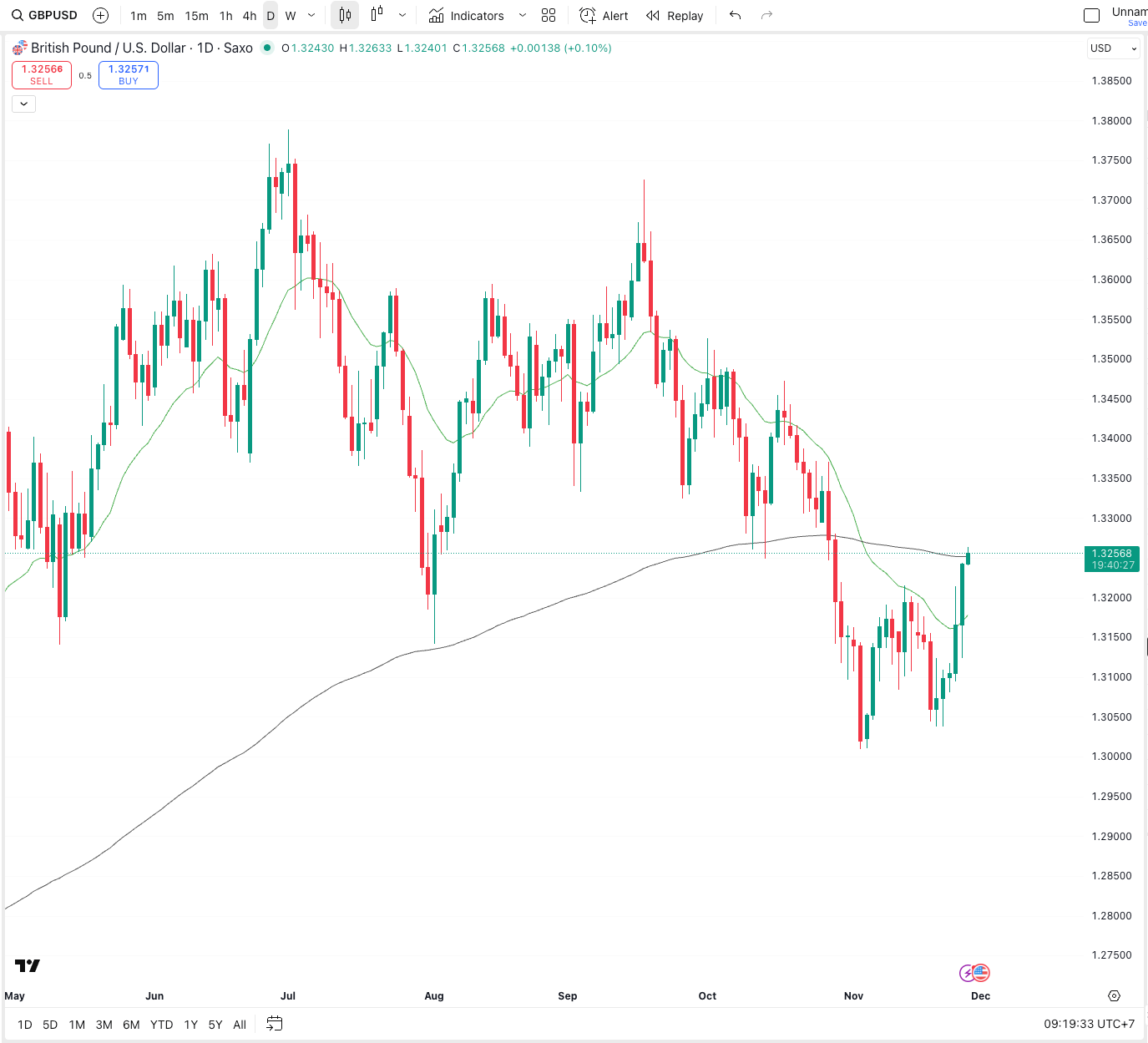

GBP Focus

The pound gained after the UK Budget delivered a larger than expected fiscal buffer.

Sterling rose to 1.3228, and strengthened against the euro as well.

The Office for Budget Responsibility confirmed that the government now has more than double its previous buffer for meeting its borrowing targets. That helped calm markets and provided GBP with some short term support.

USD Focus

The dollar softened as traders maintained expectations of a Federal Reserve rate cut in December. Economic data was mixed.

Jobless claims fell to a seven month low and business investment showed another solid month, but none of the data shifted the market’s belief that easing is coming.

Speculation around the next Fed chair also played a role. Reports suggest that Kevin Hassett is the front runner, and he is known for preferring lower interest rates. That has added to the weaker USD tone.

Markets now price an 85 percent chance of a cut next month.

AUD and NZD Focus

The New Zealand dollar jumped to 0.5695. The RBNZ delivered a rate cut but signaled confidence that the easing cycle is now over. Traders reacted positively and pushed the kiwi higher.

The Australian dollar also moved up to 0.6517. Inflation accelerated again in October which reduces the chance of further RBA cuts. That has supported the AUD for now.

Summary for Clients

This is one of the most active FX sessions of the month.

JPY is volatile, GBP is finding some support, the USD is drifting lower, and both AUD and NZD have rallied on stronger domestic signals.

If you have upcoming transfers or exposures in any of these currencies, today is a perfect day to review levels and strategy.

GBP/USD - 6 daily closes higher in a row.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X