Last week the US Dollar weakened and every major currency pushed higher against it. The Aussie Dollar gained about 1.51 percent, helped by softer US data and rising expectations that the Federal Reserve will cut rates soon.

AUD Update. Why Last Week’s CPI Boosted the Australian Dollar

Australia’s latest CPI numbers came in stronger than expected, and that gave the AUD a lift heading into the end of the week.

What the CPI Data Showed

• Inflation came in hotter than forecast

• Markets were expecting inflation to ease

• Instead, the data showed that price pressures are still sticking around

This matters because the RBA is one of the few central banks still leaning toward a tighter stance, while other major banks are getting ready to cut. When inflation stays firm like this, it keeps the RBA in a position where they may need to hold rates higher for longer.

Higher interest rate expectations usually support a currency. That is exactly what happened.

👉 Why This Boosted the AUD

While the USD weakened through the week, the AUD had an extra tailwind.

The CPI data told the market:

• The RBA is not done

• Rate cuts are not coming anytime soon

• Australia will stay relatively tighter than the US or Europe

• Capital tends to flow toward currencies backed by higher interest expectations

So the AUD strengthened not only because of USD weakness but also because investors saw the RBA’s stance holding firm.

👉 What This Means Going Forward

This week’s GDP numbers will now help shape the next move. If GDP prints strongly, it supports the idea that Australia can handle higher rates. That keeps the AUD supported. If GDP softens, it may take some of last week’s momentum out of the currency.

For athletes and expats watching the AUD, this is where timing becomes important. CPI gave the AUD a lift. GDP could either continue the move or reverse it.This week is all about event risk.

There are several big announcements that could move the market sharply.

What to Watch

Australia GDP on Wednesday

A strong number could push AUD higher again.

US data releases all week

Powell speaking, ISM numbers, ADP jobs data, unemployment claims and Core PCE on Friday. If the numbers are weak, the USD may fall further.

Euro inflation data

The Eurozone CPI flash estimate and Lagarde’s speeches will drive the Euro.

Japan

BoJ Governor Ueda speaks. Even a small change in tone can move USD/JPY quickly.

Key Pairs This Week

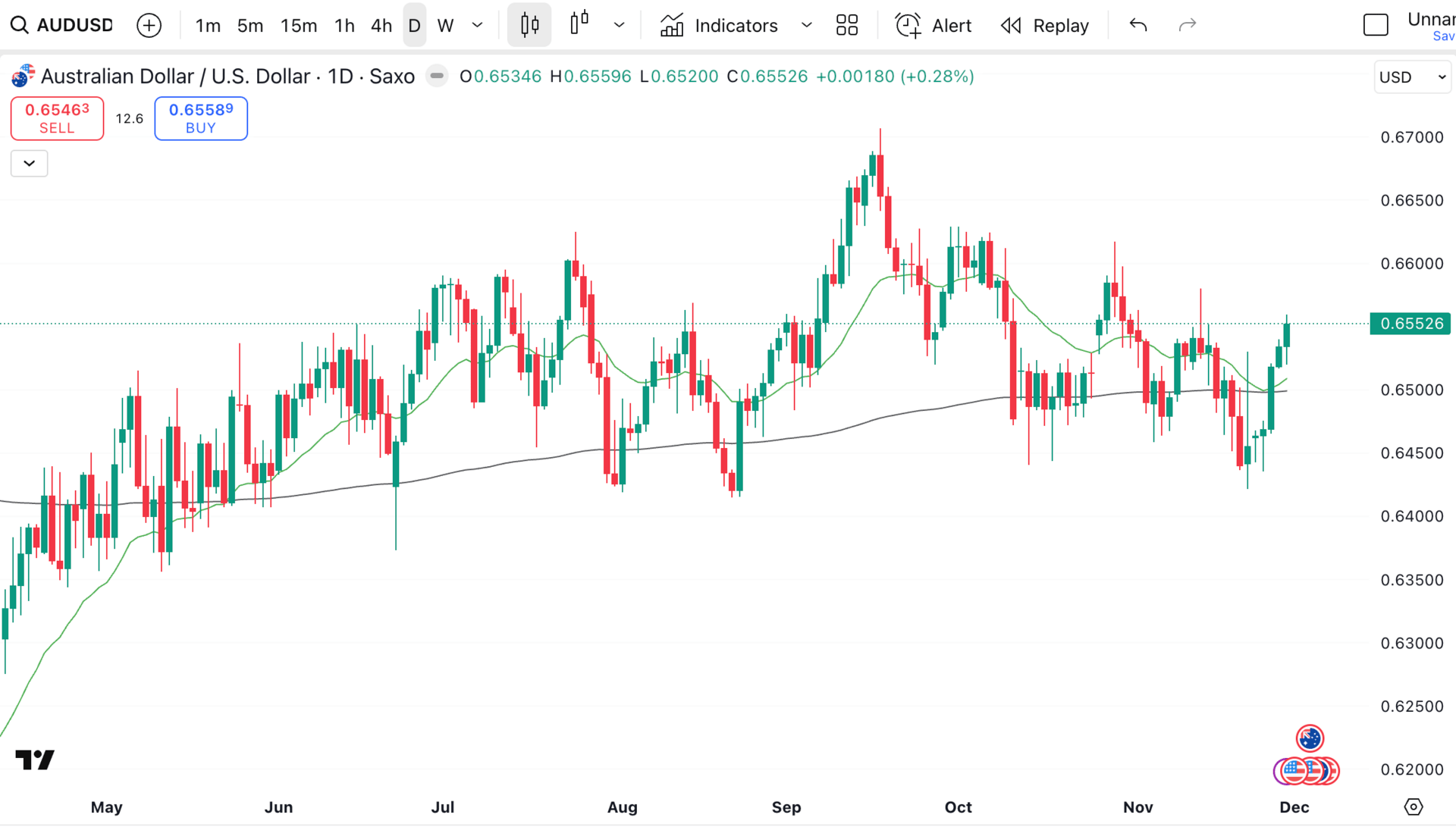

AUD/USD. Big week with GDP and heavy US data.

EUR/USD. Euro inflation and ECB commentary.

GBP/USD. No UK data so USD will drive it.

USD/JPY. Central bank signals in focus.

Why It Matters

A one or two cent move on a large contract can mean tens of thousands of dollars gained or lost. This week has the potential for fast moves in both directions. If you have an upcoming transfer, timing will matter.

Technical levels give your triggers. This week provides plenty to work with.

AUD/USD - Daily Chart

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X