USDJPY has been one of the most aggressive moves in major FX this quarter. Since mid-September, the pair has climbed more than 9%, driven by yield differentials, carry trade flows, and speculation around upcoming central bank decisions.

This week’s chart highlights a few important things happening under the surface.

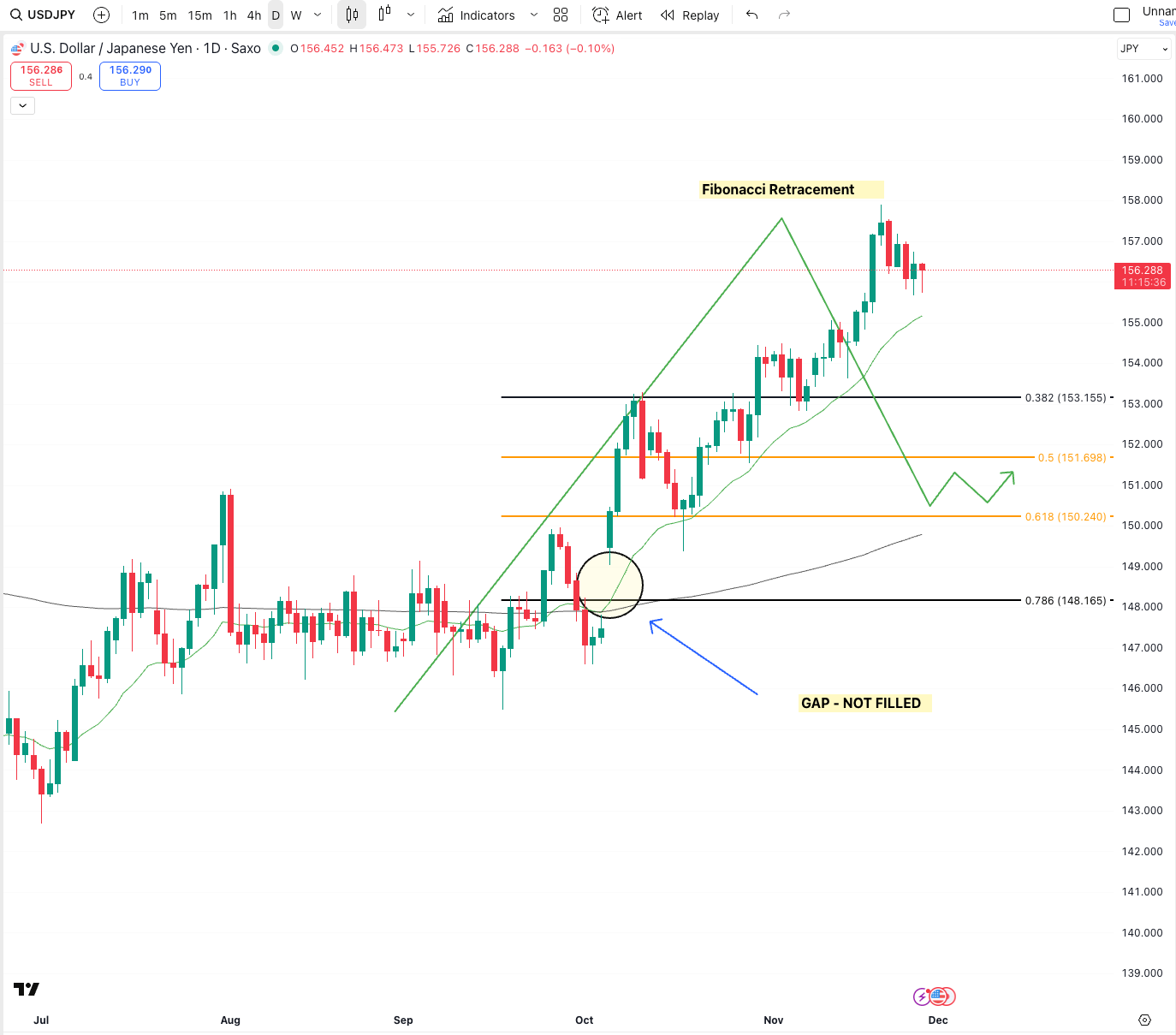

A huge run that is now losing momentum After weeks of near-vertical price action, USDJPY is finally slowing down. You can see this in the shortening candles and reduced volatility near the highs. Big moves like this rarely continue in a straight line.

A gap below that has not been filled There is a clear price gap around the 149–150 zone. Markets often return to retest these levels before resuming their main trend. It does not guarantee a pullback, but it increases the probability.

Fibonacci retracement levels lining up The 0.382, 0.50, and 0.618 Fib levels all sit below current price. These are classic retracement points where buyers often step back in.

• 153.15

• 151.69

• 150.24

If the pullback continues, these zones become important areas to watch.

The carry trade still matters Japan’s ultra-low rates have kept USDJPY elevated for years. Borrowing in JPY and buying higher-yield currencies still makes sense while Japan remains slow to tighten. But any change in tone from the Bank of Japan could unwind parts of this positioning very quickly.

Interest rate decisions are around the corner The next BOJ meeting and incoming Fed commentary could be the catalyst for the next major move. If BOJ signals even a small shift toward tightening, USDJPY could retrace quickly. If not, carry flows may keep supporting the pair.

The takeaway USDJPY is extended. The gap below adds risk. Fib levels give structure. And upcoming interest rate decisions mean volatility is likely.

For athletes and global earners being paid in JPY or converting to JPY, the next few weeks will be important. Timing could add or remove thousands.

Technical levels give your triggers.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X