Good morning all,

"The sports news this week has been dominated by one story: Socceroos legend John Aloisi taking the leap to China to lead Chengdu Rongcheng. It’s a brilliant move that highlights the growing global demand for Australian coaching talent.

But while the headlines focus on the tactical challenges of the Chinese Super League, my mind immediately goes to the financial mechanics of a move like this.

Having worked with hundreds of coaches and athletes navigating similar international transitions, I’ve seen how the excitement of a new contract can often mask a hidden financial risk that begins the moment you sign."

However, behind the celebratory photos and the signed jerseys lies a financial reality that most people completely miss. At SportsFX, we see it every day.

I call it The Silent Pay Cut.

The Risk Starts at "Yes"

Most coaches and athletes believe their financial risk begins on payday. In reality, the risk starts the second the pen hits the paper.

When a coach signs an international contract… often denominated in USD, but their life, mortgage, and school fees remain in AUD, their salary becomes a floating number.

Same contract. Same salary. Different outcome depending on the market.

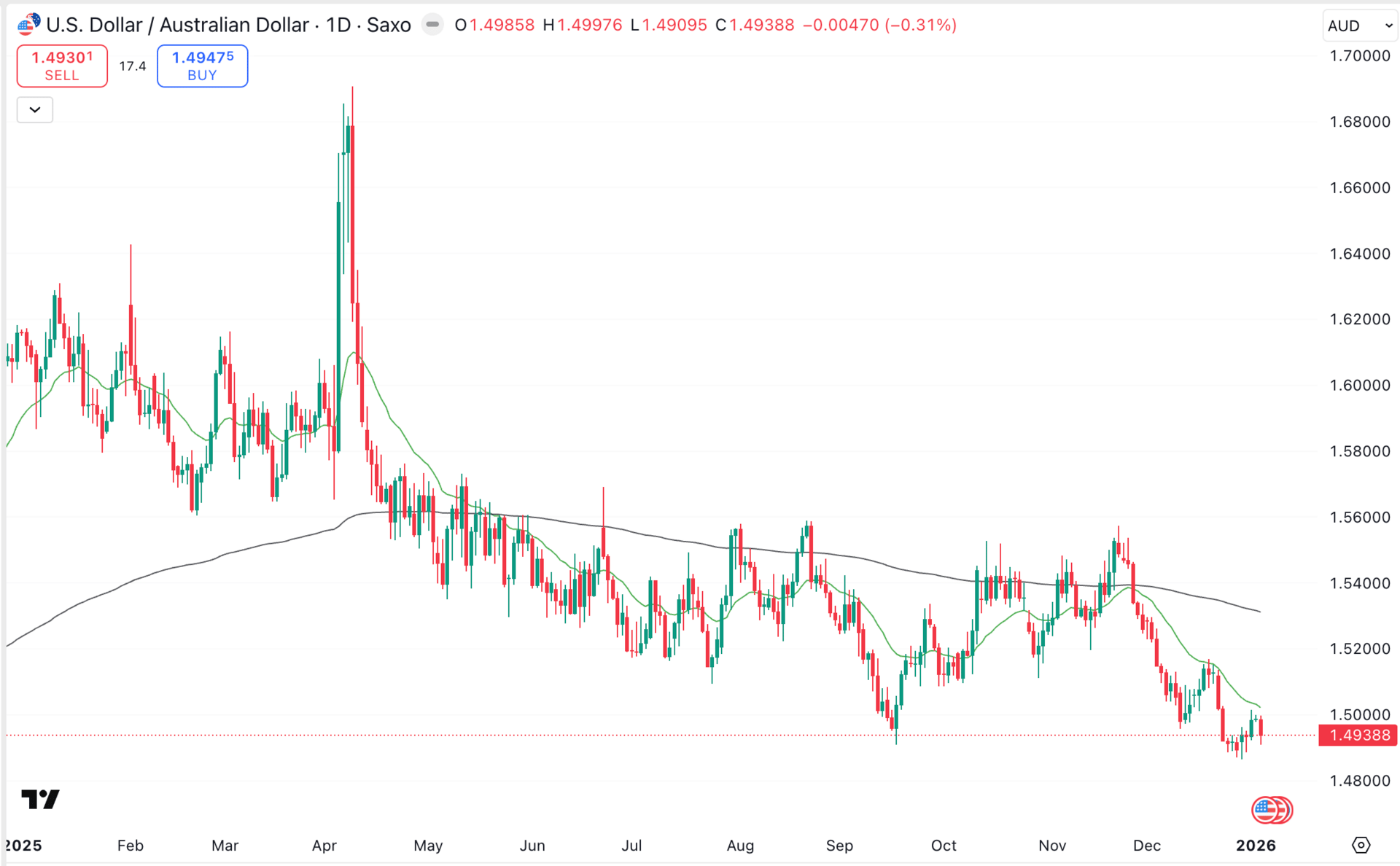

The 2025 Reality Check

Look at the numbers from this past year. In 2025 alone, the USD weakened roughly 9.5% against the AUD.

On a high-value international contract, that is effectively a 10% pay cut before the coach has even blown the first whistle. No missed bonuses, no renegotiations, and nothing "going wrong"—just the market doing what the market does.

Breaking the "Payday Cycle"

Most professionals fall into a dangerous pattern:

Get paid in foreign currency.

Accept whatever the bank rate is that day.

Transfer home.

Repeat.

The problem? The market doesn’t care about your pay schedule. Over a full season, that 5-10% swing can quietly strip tens or hundreds of thousands of dollars from the true value of the contract.

How SportsFX Changes the Game

This is exactly why SportsFX exists. We don't just "send money"; we manage risk from day one. Our process for coaches like John ensures that the value signed for is the value received:

Contract Mapping: We analyse the full exposure the moment the contract is signed.

Risk Removal: We eliminate downside risk across staged payments throughout the year.

Certainty: We provide a "floor" so the client knows exactly what their income is worth in AUD.

Upside Management: We keep the door open for gains if the market moves in their favour.

The Bottom Line

Whether it's China, Europe, or the Middle East, moving overseas is about more than just the sport. It's about protecting the income you've worked your entire life to earn.

Contract risk doesn’t start on payday. It starts at signature.

Are you (or a client) looking at an international move? Don't leave your earnings to the mercy of the markets. Let's map out your contract before the first payment lands.

USD/AUD Daily Chart - 2025

Here’s why this matters for athletes and anyone earning or moving money internationally.

What this means in real terms

To understand the real impact, it helps to translate percentage moves into actual money.

Consider an athlete on a USD-denominated contract, with family living and spending in Australian dollars, or sending home to invest.

USD $1m per year

A 10% move in USD/AUD equates to roughly $100,000 less in local purchasing power over the year.

USD $3m per year

The same move equates to approximately $300,000.

USD $5m per year

Now the number becomes harder to ignore. Around $500,000 in lost value.

👉 Nothing about these contracts changed.

👉 Training didn’t change.

👉 Performance didn’t change.

Only the currency did.

This is why many athletes first feel the impact when making major decisions. Buying property. Supporting family. Planning education. Thinking about long-term security.

The money is there. It just doesn’t stretch as far as expected.

Why this catches people off guard

Most athletes don’t actively manage currency exposure. And that’s not due to carelessness.

The system encourages passivity.

👉 Banks convert funds when they arrive.

👉 Apps are cool and show today’s rate.

👉 Multi-currency accounts make things feel organised and under control.

But none of these protect future income.

They all operate after the exposure has already played out.

So when the market moves against you, the loss is embedded quietly inside the rate. There’s no alert. No warning. No line item that says “currency loss”.

It’s simply accepted.

That’s why currency risk is often only recognised in hindsight.

Think of currency like insurance

Athletes insure everything that matters.

Their body.

Their income.

Their property.

Their lifestyle.

But most don’t insure the currency their contract is paid in.

Currency risk is one of the largest, most predictable risks an overseas athlete faces. And yet it’s usually left unmanaged.

Tools like forward contracts exist for the same reason insurance exists. Not to make money, and not to speculate, but to protect outcomes.

You hope you don’t need insurance.

You’re glad you have it when conditions change.

The real takeaway

This isn’t about timing markets or predicting where USD/AUD goes next.

It’s about recognising that currency is part of the contract, not an afterthought.

Professional businesses don’t leave future cashflows exposed to daily market swings. They structure them.

Athletes and international clients should be no different.

👉 The goal isn’t to chase the best rate.

👉 It’s to protect certainty, so income, lifestyle, and long-term plans aren’t left to chance.

This is what managing currency professionally actually looks like.

This same currency risk doesn’t just affect athlete salaries.

We see it regularly in international property purchases, inheritances, business exits, and staged transfers, where timing and structure matter far more than the headline rate.

In each case, the mistake is the same. Currency is treated as a transaction, not a risk.

And by the time it’s noticed, the outcome is already locked in.

This Week’s Articles (Optional Reading)

Helping the people who grew up offline – Great service is not just fast and digital..

Why your salary in a mirage – Our Strategic Approach.

Monday Market Wrap – While the Greenback suffered its worst year in 2025 since 2017.

Information is everywhere.

Markets move fast.

Your advantage is a strategy built before the market decides for you.

If you earn or move money internationally and want clarity before the market decides for you, you can book a short strategy call below.

Now it looks like this

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

Chris Broadfoot

Founder, SportsFX & CB3 Global Payments

Disclaimer: Please note: I do not have access to the specific details of John Aloisi’s contract or financial arrangements. I am using his recent move purely as a high-profile, real-world example of the currency challenges faced by Australian professionals working abroad. My insights are based on my experience managing similar exposures for hundreds of athletes and coaches across the global sporting landscape.