Welcome to This Week’s Currency Advantage

The past few weeks have marked a real turning point for this newsletter. What started as simple FX updates has now become the home base for everything I do across SportsFX, CB3 Global Payments, and my work with global earners.

If you are reading this, you are either a client, a partner, or someone who has trusted me with questions about cross-border money. My goal is to make The Currency Advantage the single best resource for understanding what is happening in the currency markets and how it affects your contract, your property purchase, your business, or your family wealth.

Each week I will bring together the most important moves in the major currencies, the real client stories that show what is possible with the right strategy, and practical insights to help you stay in control of your money across borders.

👉 Simple. Clear. Actionable.

Because in global finance, clarity is an advantage.

Let’s get into it.

This week’s insight starts with a real story

Before we get into the market moves, I want to start with something far more important.

A real person. A real moment. A real outcome.

This week I received a call from a client I helped a few years ago.

A familiar story. A family member overseas had passed away. A €285,000 inheritance was being prepared for transfer from Europe to Australia.

Their solicitor was ready to send the funds straight into their AUD bank account. Simple. Fast. Done.

But simple is not always smart.

When inheritances are paid directly into AUD, solicitors do not check the rates. They do not watch the markets. They simply process the transfer through their trust account and move on.

That is how people lose between $15,000 and $18,000 without ever knowing it.

Because €285,000 sent blindly at the wrong time can land at around $484,500 AUD.

But collected into our EUR account first, held securely, and converted with strategy, that same inheritance can land above $500,000 AUD.

👉 Same inheritance. Same money. Completely different outcome.

This is the part of the process most people never see. Solicitors are brilliant at legal work, but they are not currency specialists. Their priority is speed and compliance. Not market timing. Not rate protection. Not maximising what ends up in your account.

That is where we step in.

We help clients collect funds into the right currency account.

We guide the instructions to the solicitor.

We monitor the market.

We strike when the rate works in your favour.

And we make sure more of the inheritance stays with you and not the banks.

For this family, a simple call back was the difference between accepting whatever the market happened to be doing that day and gaining tens of thousands extra.

Real money.

Real impact.

Real advantage.

If you or someone you know is expecting an overseas inheritance, property settlement, or large transfer, this is one of the easiest places to save serious money with the right structure.

This Week’s Market Highlights

A simple overview of the biggest currency moves and opportunities from the past seven days.

Choose the updates that matter most to you.

GBP Focus

All eyes shift sharply to the UK Budget.

Read the full breakdown ⬇

AUD Focus

CPI beats across headline and trimmed mean. Key movers and levels

Read the full breakdown ⬇

NZD Focus

RBNZ shocks markets with a neutral tone. NZD breaks higher.

USD Focus

US PPI, Retail Sales, and rate expectations driving flows.

Overall Market Snapshot 📊

A quick, at-a-glance look at the major global markets and what’s driving them.

This section is designed for readers who want the broader context behind currency moves without getting lost in technical noise.

Why this matters:

Currencies rarely move in isolation. Equity trends, risk sentiment, commodities, and crypto rotations all influence where AUD, USD, GBP, and EUR go next. The snapshot below gives you the bigger picture.

Asset | Recent Move | What’s Driving It |

|---|---|---|

S&P 500 (US Equities) | The S&P 500 (the major benchmark for US stocks) has experienced significant volatility, moving from a sharp weekly decline of nearly 2.0% to a strong rebound fueled by rate cut hopes. The market's quick U-turn shows just how much investor sentiment is tied to the actions of the Federal Reserve. | The primary fuel for this volatility is Fed Uncertainty. Market expectations for a US interest rate cut in the near future have swung wildly, from a low probability to over 70% likelihood in a matter of days. This means the market is driven less by company performance and more by betting on the Fed's next move. This "Fed watch" creates massive, sudden capital flows. |

Crypto (Bitcoin & Major Tokens) | Bitcoin has recently shown a significant rebound, extending its recovery above the $91,000 level. This snaps a multi-week losing streak and reflects renewed confidence and institutional inflows. | The recent moves are strongly influenced by Institutionalisation (e.g., the launch and trading of new crypto ETFs) and a lack of faith in the Traditional Banking System. As a completely digital, borderless asset, Crypto attracts capital looking for assets that are fully uncorrelated to traditional stocks and sovereign debt. |

Gold | Gold has demonstrated strong resilience, rallying by nearly 60% over the past year and trading near $4,200 per ounce. It continues to be one of the best-performing asset classes against traditional benchmarks. | The primary drivers are Geopolitical Instability (ongoing conflicts in Ukraine and the Middle East), and sustained Central Bank Buying. Central banks are diversifying their reserves away from traditional sovereign currencies, seeing Gold as the only truly safe asset that can’t be frozen or devalued by any single government. |

Oil (Crude / Energy) | Oil has recently seen a pullback after earlier strength, easing slightly due to a larger-than-expected build in US inventories. Prices are also capped by optimism around potential geopolitical de-escalation. | Oil is directly tied to Global Economic Activity and Geopolitical Risk. Increasing global demand (especially in Asian industrial hubs) typically pushes prices up, while any sign of reduced supply risk (like peace talks) eases prices down. Oil prices are a leading indicator of global inflation. |

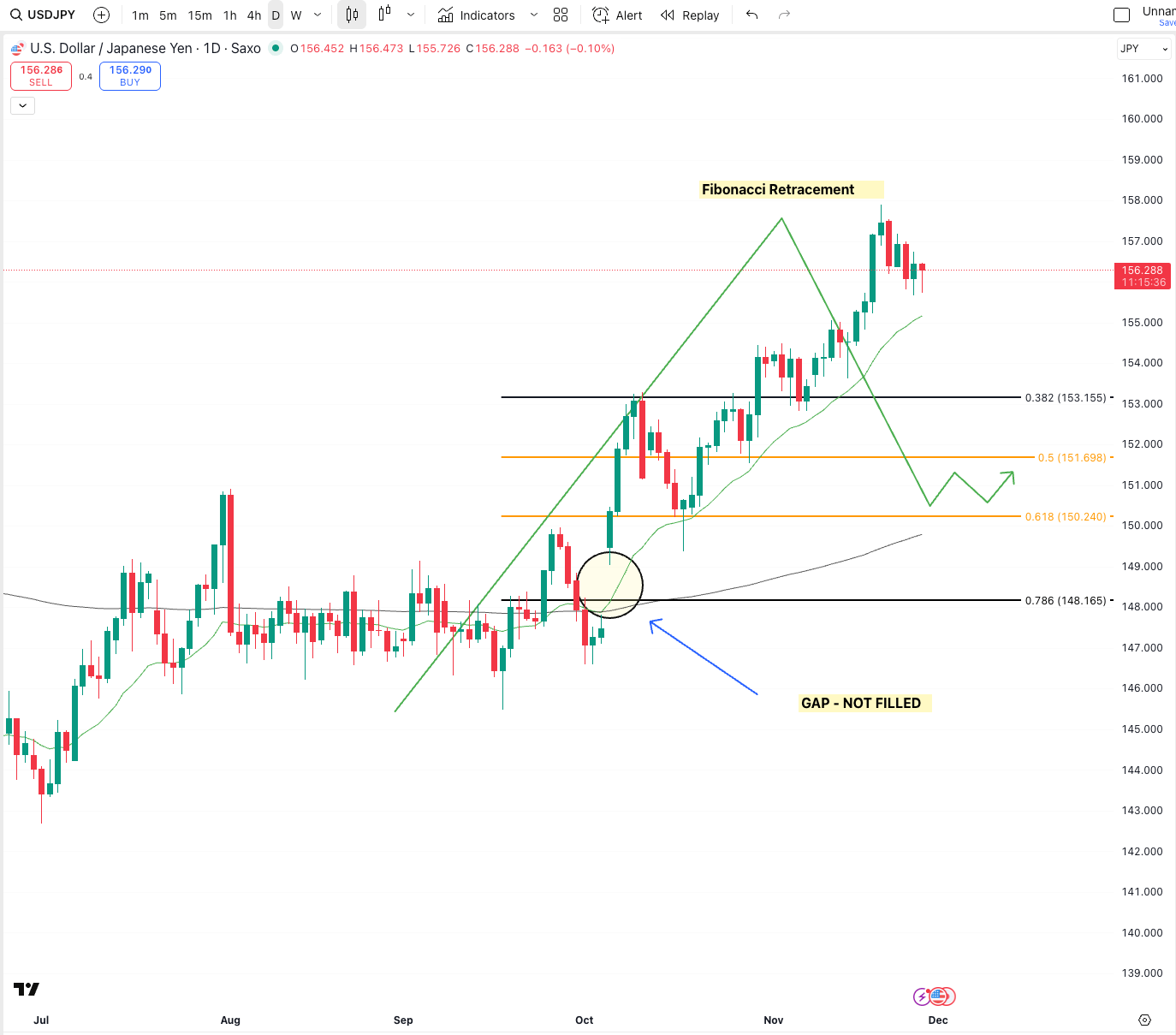

Chart of the Week: USDJPY – A Setup Worth Watching

USDJPY has been one of the most aggressive moves in major FX this quarter. Since mid-September, the pair has climbed more than 9%, driven by yield differentials, carry trade flows, and speculation around upcoming central bank decisions.

This week’s chart highlights a few important things happening under the surface.

1. A huge run that is now losing momentum

After weeks of near-vertical price action, USDJPY is finally slowing down. You can see this in the shortening candles and reduced volatility near the highs. Big moves like this rarely continue in a straight line.

2. A gap below that has not been filled

There is a clear price gap around the 149–150 zone. Markets often return to retest these levels before resuming their main trend. It does not guarantee a pullback, but it increases the probability.

3. Fibonacci retracement levels lining up

The 0.382, 0.50, and 0.618 Fib levels all sit below current price. These are classic retracement points where buyers often step back in.

• 153.15

• 151.69

• 150.24

If the pullback continues, these zones become important areas to watch.

4. The carry trade still matters

Japan’s ultra-low rates have kept USDJPY elevated for years. Borrowing in JPY and buying higher-yield currencies still makes sense while Japan remains slow to tighten. But any change in tone from the Bank of Japan could unwind parts of this positioning very quickly.

5. Interest rate decisions are around the corner

The next BOJ meeting and incoming Fed commentary could be the catalyst for the next major move. If BOJ signals even a small shift toward tightening, USDJPY could retrace quickly. If not, carry flows may keep supporting the pair.

The takeaway

USDJPY is extended. The gap below adds risk. Fib levels give structure. And upcoming interest rate decisions mean volatility is likely.

For athletes and global earners being paid in JPY or converting to JPY, the next few weeks will be important. Timing could add or remove thousands.

Technical levels give your triggers.

Information is everywhere.

Markets move fast.

Your advantage is a strategy built before the market decides for you.

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

👉 Join The Currency Advantage Weekly

One email. Every Week. Market intelligence made simple.

👉 Watch chart breakdowns on YouTube

Technical levels give your triggers.

👉 Follow me on Linkedin

👉 Follow me on Instagram

👉 Follow me on X