Good morning all,

So, you’re playing some of the best football of your career. You’re hitting your marks in the B.League, or you’re the powerhouse of your Rugby Union side. You’re earning what looks like a great salary in Yen.

But there’s a problem. Every month, when you send money home to Australia, the UK, or the US, your pay check is shrinking.

It isn't because you're playing poorly. It’s because the Japanese Yen is currently the worst-performing major currency in the world. While the stands are full and the league is growing, your global purchasing power is under attack.

This week’s focus: Japanese Yen (JPY), which has fallen over 50% against the USD, GBP, EUR, and AUD since 2020.

The "Silent" Pay Cut Hidden in the Yen

Success is Local, Currency is Global

Most people think currency only matters when money is transferred. That assumption is costly.

If you earn in one currency and live, spend, or plan in another, your income is exposed long before any conversion happens. When markets move, the impact is already locked in, whether you’ve noticed it or not. This is how currency quietly reshapes outcomes after contracts are signed.

What Just Happened

While the Nikkei has hit record highs, the Yen has been the "whipping boy" of global markets. Over the past five years, professional athletes in Japanese Football, Rugby, and Basketball have seen the value of their Yen salaries eroded by a "perfect storm" of low interest rates and a massive global "Carry Trade".

Against major home-base currencies, the JPY has seen devastating drops:

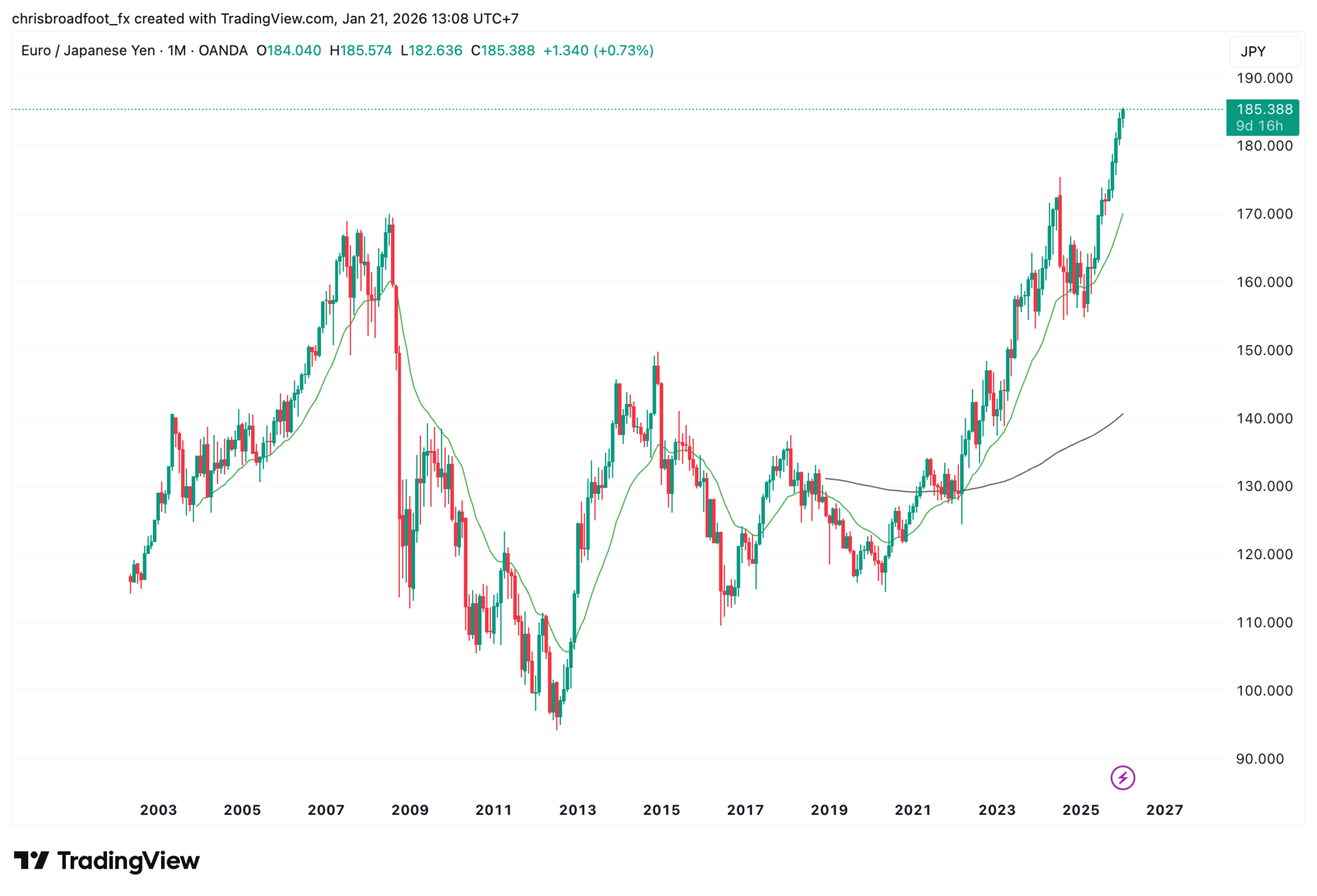

vs. EUR: Down 57% (Hitting the highest exchange rates ever recorded)

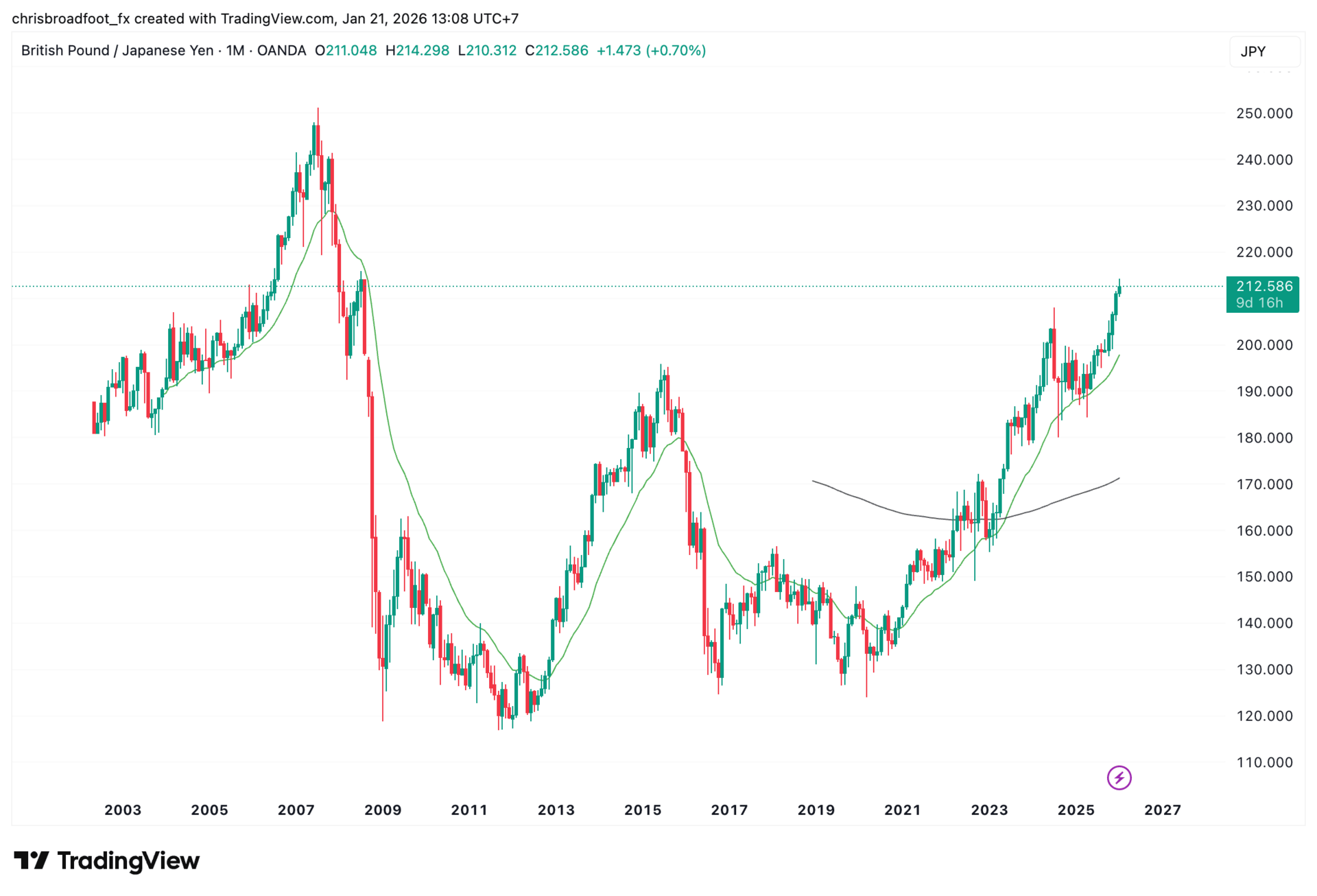

vs. GBP: Down 51% (Highest since 2008)

vs. USD: Down 50% (Highest since 1990)

vs. AUD: Down 45% (Highest since 2007)

What This Means in Real Terms

To understand the real impact, look at the math for a standard 3-year contract valued at 100,000,000 Yen per year.

Year | JPY Contract Value | Est. Exchange Rate | Value in USD | The "Silent" Pay Cut |

2023 | 100,000,000 | 128.00 | $781,250 | Starting Point |

2024 | 100,000,000 | 142.00 | $704,225 | – $77,025 |

2025 | 100,000,000 | 157.00 | $636,942 | – $67,283 |

Total | – $144,308 loss |

👉 Nothing about the contract changed.

👉 Training didn’t change.

👉 Performance didn’t change.

Only the currency did. Over three years, this athlete lost over $144,000 USD in purchasing power purely due to JPY weakness. For those on $1M or $3M contracts, the loss is in unfathomable ranges.

EUR/JPY - Monthly Chart - 2003-2026

GBP/JPY - Monthly Chart - 2003-2026

The "Why": Why is this happening? It comes down to a "Carry Trade" and a massive gap in interest rates. While the rest of the world raised rates to fight inflation, Japan kept theirs near zero. Investors have been borrowing "cheap" Yen to buy "expensive" Dollars and Euros, driving the Yen's value into the ground.

Tomorrow’s High Stakes: The Bank of Japan Decision This Friday is a "Volatility Alert" day. The Bank of Japan (BoJ) will meet to decide on interest rates. Recent reports show the Japanese bond market is experiencing "chaotic" trading as investors bet on whether the BoJ will finally be forced to hike rates to save the currency.

If they hold steady, the Yen could slide even further. If they hike, we could see a sudden, sharp "snap back."

What this means for you: Timing your transfers this week is no longer just about convenience—it’s about protecting your wealth. Are you watching the charts, or are you just letting the bank take their cut?

Think of currency like insurance

Athletes insure everything that matters.

Their body.

Their income.

Their property.

Their lifestyle.

But most don’t insure the currency their contract is paid in.

Currency risk is one of the largest, most predictable risks an overseas athlete faces. And yet it’s usually left unmanaged.

Tools like forward contracts exist for the same reason insurance exists. Not to make money, and not to speculate, but to protect outcomes.

You hope you don’t need insurance.

You’re glad you have it when conditions change.

The real takeaway

Success in Japan shouldn't be penalised by market volatility. Whether you are buying property back home, supporting family, or planning for post-career security, the money is there—it just isn't stretching as far as it used to.

Athletes and international clients should be no different.

👉 The goal isn’t to chase the best rate.

👉 It’s to protect certainty, so income, lifestyle, and long-term plans aren’t left to chance.

This is what managing currency professionally actually looks like.

In practice, this usually means structuring forward contracts, staged conversions, or holding currency until timing makes sense for the contract, not the calendar.

This same currency risk doesn’t just affect athlete salaries.

We see it regularly in international property purchases, inheritances, business exits, and staged transfers, where timing and structure matter far more than the headline rate.

In each case, the mistake is the same. Currency is treated as a transaction, not a risk.

And by the time it’s noticed, the outcome is already locked in.

This Week’s Articles (Optional Reading)

Last Week’s Newsletter – Beyond the NBL: The high-stakes math of the global basketball migration

Build Trust First and Geography Stops Mattering – Results travel. Reputation multiplies. Good clients find you wherever you go.

Chart of the Week: Snapshot of the JPY v USD, EUR, GBP & AUD

Monday Market Wrap – All eyes are on the Bank of Japan (BOJ) this Friday

Information is everywhere.

Markets move fast.

Your advantage is a strategy built before the market decides for you.

If you earn or move money internationally and want clarity before the market decides for you, you can book a short strategy call below.

Now it looks like this

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

Chris Broadfoot

Founder, SportsFX & CB3 Global Payments