Good morning,

After the extreme volatility of 2025, many people expected 2026 to start quietly.

Instead, the US Dollar has already fallen close to 3% in the first few weeks of the year. Last week delivered the sharpest one-week decline since 2025.

This isn’t noise. It’s the market repricing risk.

Before looking forward, it’s worth remembering what we just came through.

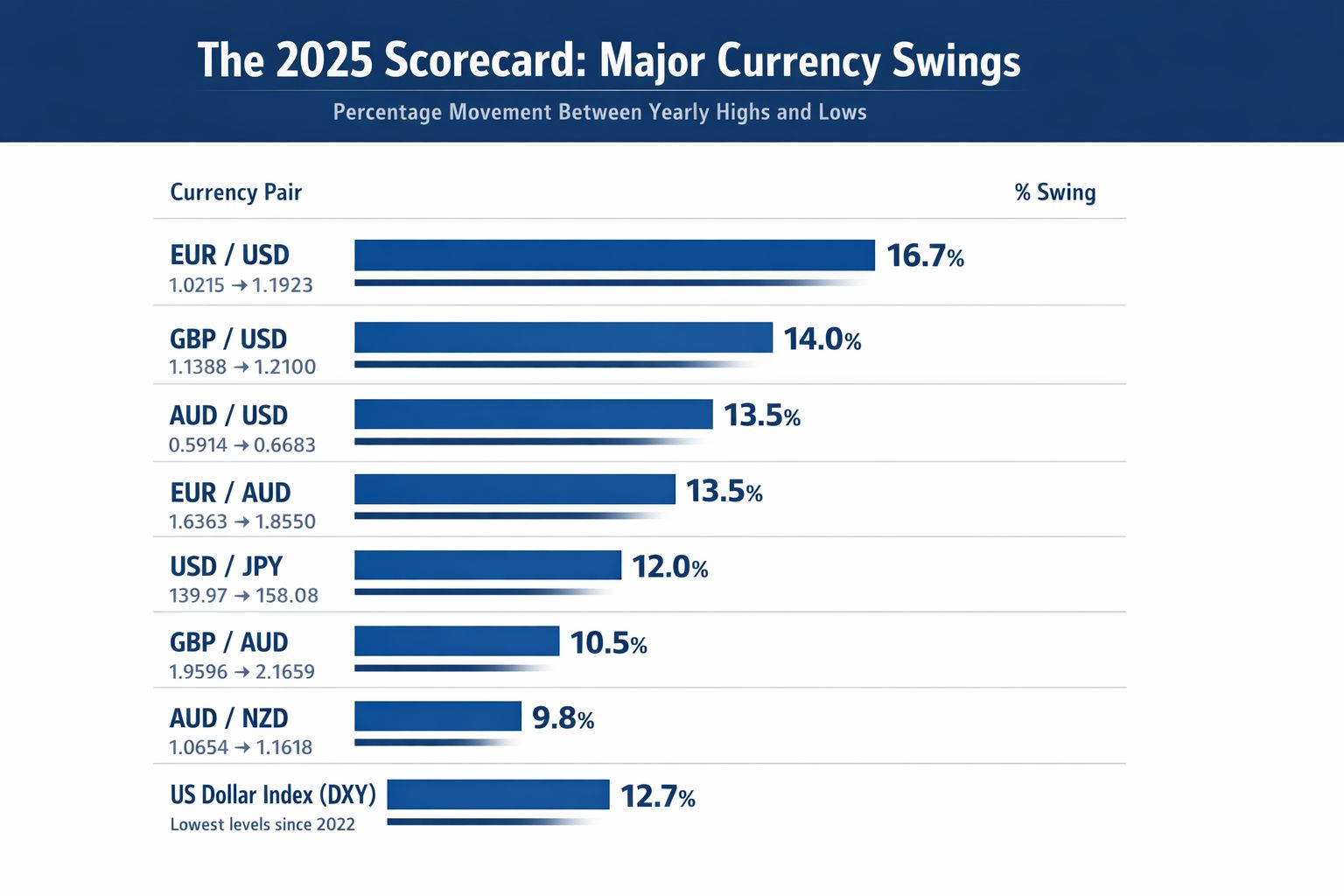

The 2025 Scorecard

In 2025, major currency pairs moved between 10% and 17% from high to low. EUR/USD, GBP/USD, AUD/USD and even the US Dollar Index itself all experienced double-digit swings. That level of volatility is no longer unusual. It is becoming the norm.

When you start a new year with a 3% move in January, the risk for the remaining eleven months compounds quickly.

The Policy Divorce Driving the Move

The key driver behind the current Dollar weakness is interest rate divergence.

In the US, the Federal Reserve is under growing pressure to cut rates as the labour market softens. Markets are now pricing US rates closer to 3.25% by year-end.

📊 Australia is moving in the opposite direction.

Underlying inflation has pushed back up to 3.4%, well above the RBA’s target. As a result, the Reserve Bank of Australia is now widely expected to hike rates again, with expectations building around a cash rate of 3.85%.

When one central bank is cutting and another is hiking, capital moves. Those flows don’t last days. They last months.

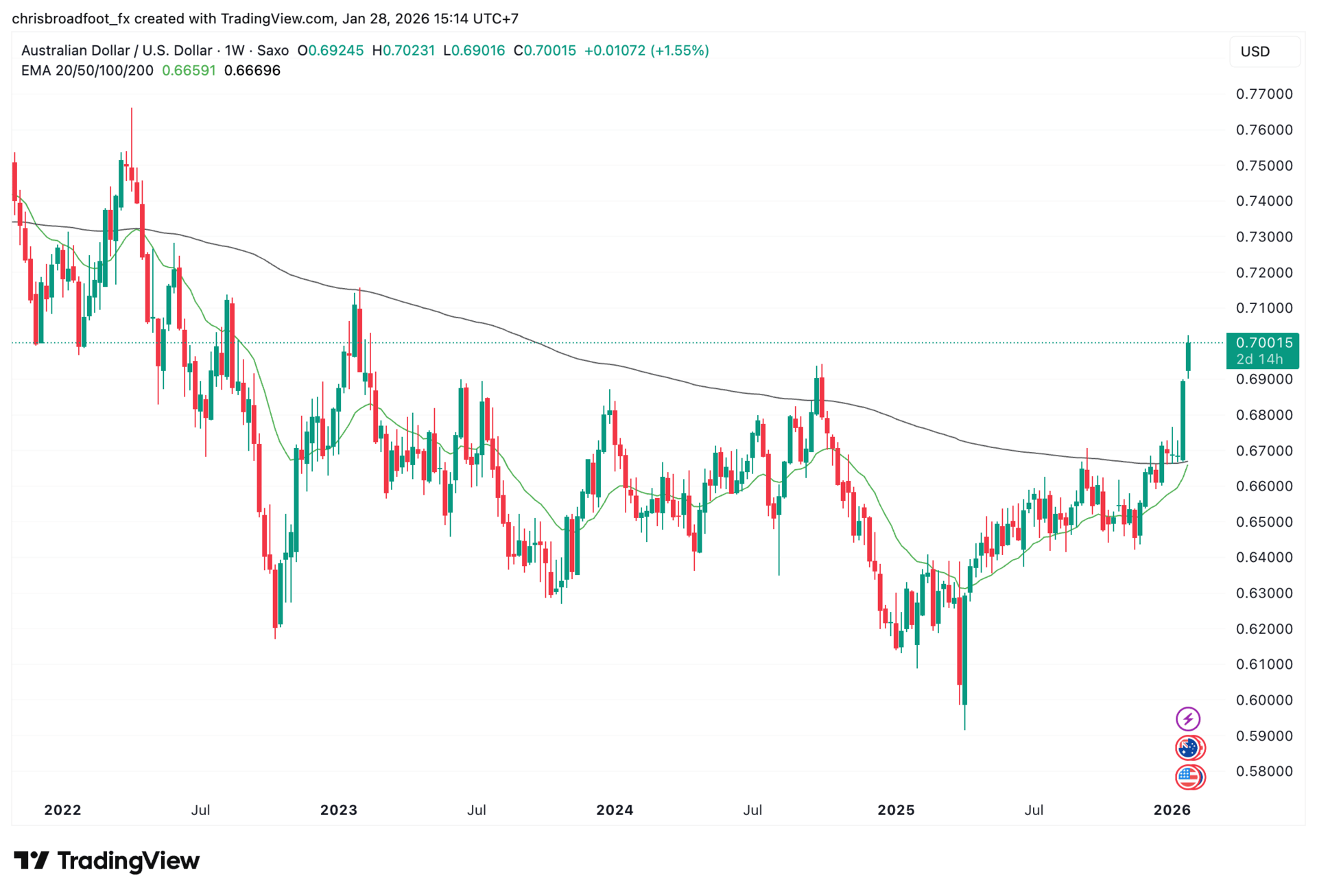

This is why AUD/USD is now testing the 0.70 level for the first time since early 2023.

If this level breaks and holds, it signals a structural shift rather than a short-term bounce.

AUD/USD Weekly Chart - Highest since Feb 2023

What This Means for Athletes Earning in USD

If you are earning in US Dollars, or in a USD-pegged currency like the Saudi Riyal, AED, or QAR this matters immediately.

A 3% move in one month is a direct pay cut before the money even hits your account.

Add in ongoing political dysfunction in the US, the risk of a government shutdown later this month, and global uncertainty around Japan and the Yen carry trade, and the probability of another 10% swing this year is very real.

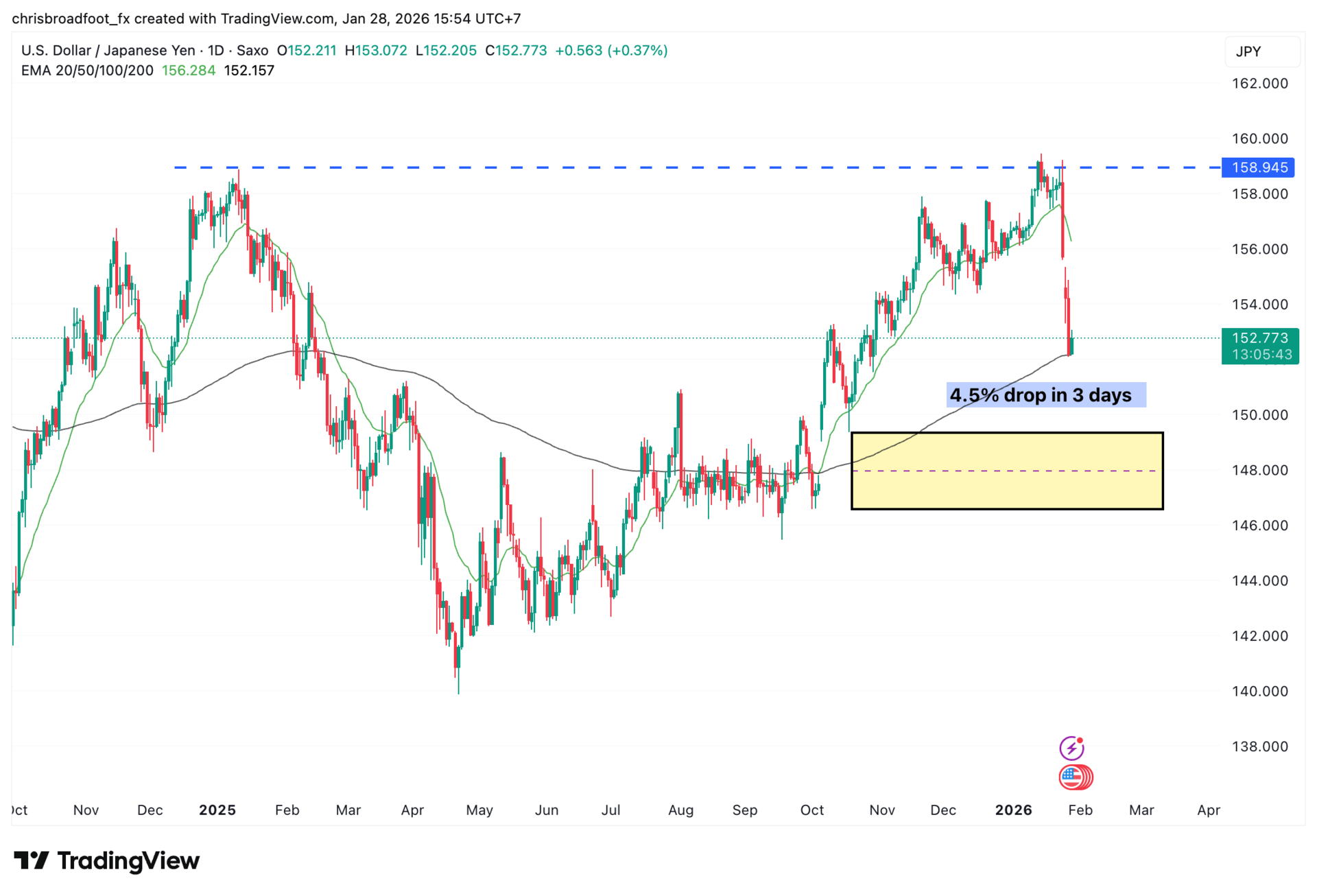

The strengthening of the Japanese Yen, now intervention-backed around the 160 level, is forcing investors to unwind carry trades. That process involves selling Dollars and buying Yen, which adds further pressure to the USD.

This is how contracts quietly lose value. Not through bad decisions, but through unprotected exposure.

USD/JPY Daily Chart - 4.5% Drop in 3 days.

What This Means for Importers and Sports Tour Companies

While athletes are playing defence, businesses that buy in USD are currently seeing one of the best pricing windows in years.

With AUD/USD trading around 0.68 to 0.70, levels not seen since February 2023, this is an opportunity to bring certainty back into budgets and margins.

For many importers and sports tour operators, the question isn’t whether the Dollar rebounds. It’s whether costs are protected if it does.

This is where forward contracts come into play.

A Practical Strategy We Are Seeing Work

For many businesses, the most sensible approach right now is not all-in or all-out.

We are advising many clients to consider securing around 50% of their USD exposure using forward contracts at current levels.

➡ Why 50%?

It locks in a strong base rate for costs, protecting margins if the Dollar strengthens again. At the same time, it leaves flexibility to benefit if the USD continues to weaken toward 0.72 and beyond.

This is not about calling tops or bottoms. It’s about removing stress from planning and protecting cash flow.

The Bigger Picture

Currency risk doesn’t announce itself. It compounds quietly.

The biggest threat to income and margins in 2026 isn’t fees or platforms. It’s unprotected exposure in a market that has already proven how far it can move.

If you are earning in USD this year, or buying in USD, this is worth a conversation.

Different situations require different structures, but the worst strategy is doing nothing and hoping volatility disappears.

If you’d like to talk through how this applies to your contract or your business, you can book time with me directly. The earlier these conversations happen, the more options you have.

This Week’s Articles (Optional Reading)

Last Week’s Newsletter - The 50% Pay Cut – Is Your Japanese Success Being Eroded?

Beyond the NBL - The world of currency management in Global Basketball

The $5,000 Gold Signal – Why the US Dollar is being "Sacrificed"

Information is everywhere.

Markets move fast.

Your advantage is a strategy built before the market decides for you.

If you earn or move money internationally and want clarity before the market decides for you, you can book a short strategy call below.

Now it looks like this

👉 Book a Currency Strategy Call

For athletes, expats, property buyers, and global professionals.

Chris Broadfoot

Founder, SportsFX & CB3 Global Payments